What Is MACD? - Moving Average Convergence/Divergence momentum oscillator How this indicator works bullish MACD crossing above zero is considered bullish, while crossing below zero is bearish. When the MACD line crosses from below to above the signal line, the indicator is considered bullish. crossing above to below bearish signal. Divergence … [Read more...] about macd indicator how to use formula etc

Technical Indicators

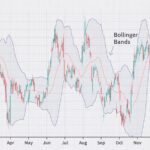

oscillator vs indicators indicators Oscillators: Rather than being overlaid on a price chart, technical indicators that oscillate between a local minimum and maximum are plotted above or below a price chart. Examples include the stochastic oscillator, MACD, or RSI. Relative strength index (RSI) Moving average convergence divergence (MACD) Bollinger … [Read more...] about Technical Indicators

Position Trading (vs Investing vs swing trading va intraday trading)

What is Position Trading Position Trading is a long term investing approach which follows the strategy of buy-and-hold for months or even years. position trading vs swing trading Swing traders capitalize on short-term price swings, lasting from days to weeks. While position traders hold positions for much longer, sometimes for months or years. positional … [Read more...] about Position Trading (vs Investing vs swing trading va intraday trading)

candlestick pattern chart explained

candle sticks can be in 1/5/15/30 mins or hour/day/week/monhts/ year. 5 minutes candle every candle has 5 minutes On a 5-minute chart, a new candle will be formed every 5 minutes. I.e from 9:15AM to 9:20AM will be one candle, the second candle will be between 9:20 to 9:25 and so on The body, which represents the open-to-close range The wick, or shadow, … [Read more...] about candlestick pattern chart explained