candle sticks can be in 1/5/15/30 mins or hour/day/week/monhts/ year.

5 minutes candle every candle has 5 minutes

On a 5-minute chart, a new candle will be formed every 5 minutes. I.e from 9:15AM to 9:20AM will be one candle, the second candle will be between 9:20 to 9:25 and so on

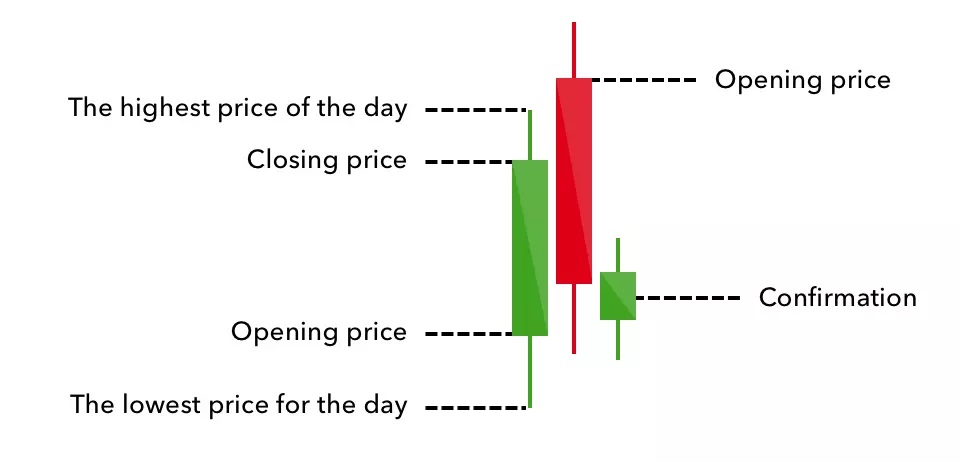

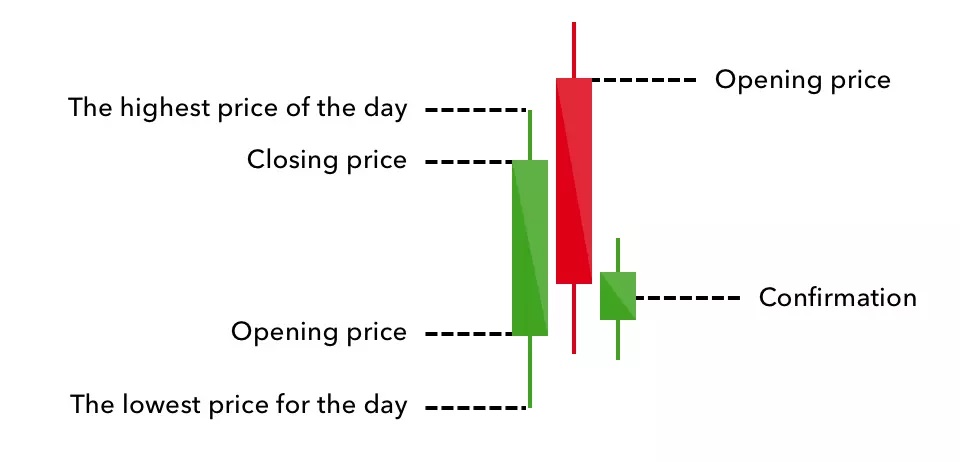

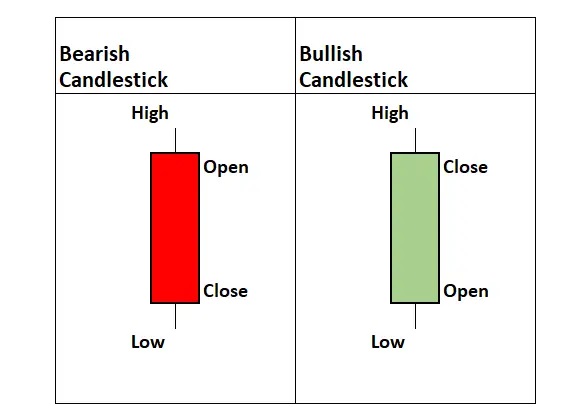

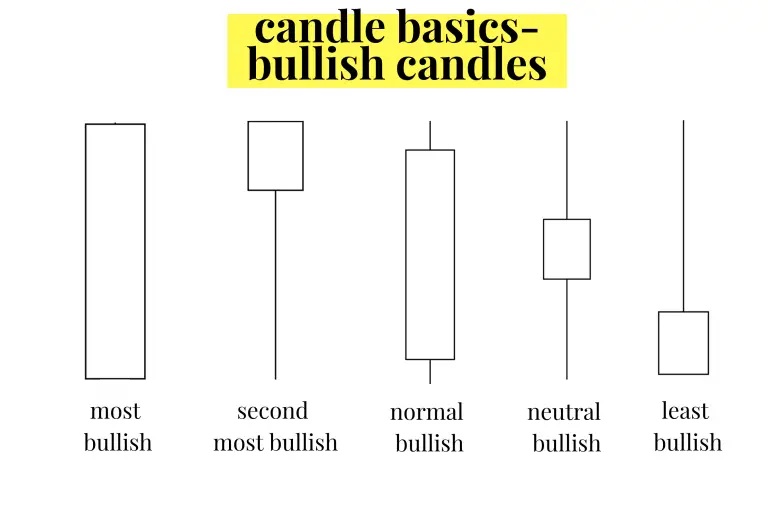

- The body, which represents the open-to-close range

- The wick, or shadow, that indicates the intra-day high and low

- The color, which reveals the direction of market movement – a green (or white) body indicates a price increase, while a red (or black) body shows a price decrease

Six bullish candlestick patterns

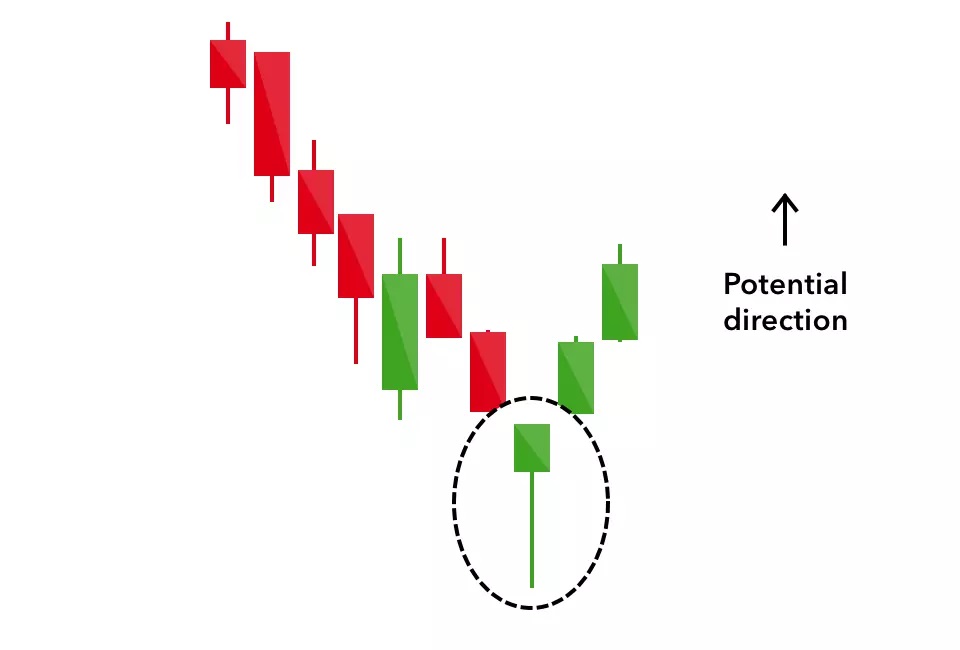

Hammer

Inverse hammer

Bullish engulfing

The first candle is a short red body that is completely engulfed by a larger green candle.

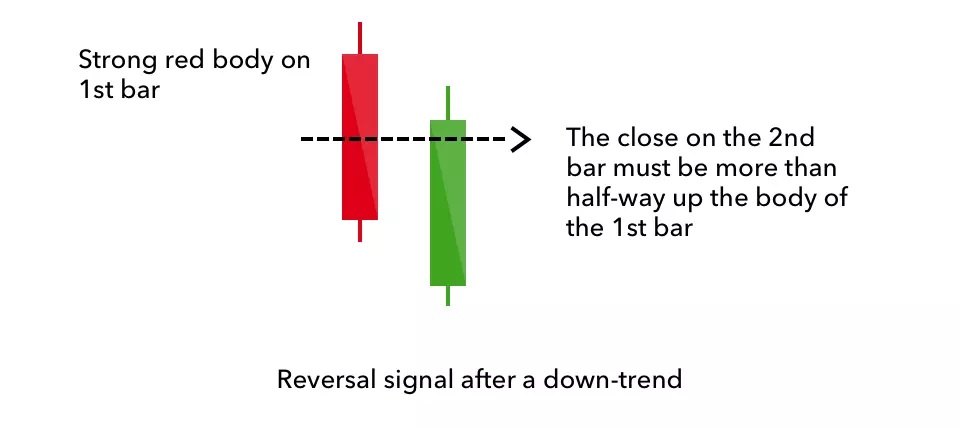

Piercing line

a significant gap down between the first candlestick’s closing price, and the green candlestick’s opening. It indicates a strong buying pressure, as the price is pushed up to or above the mid-price of the previous day.

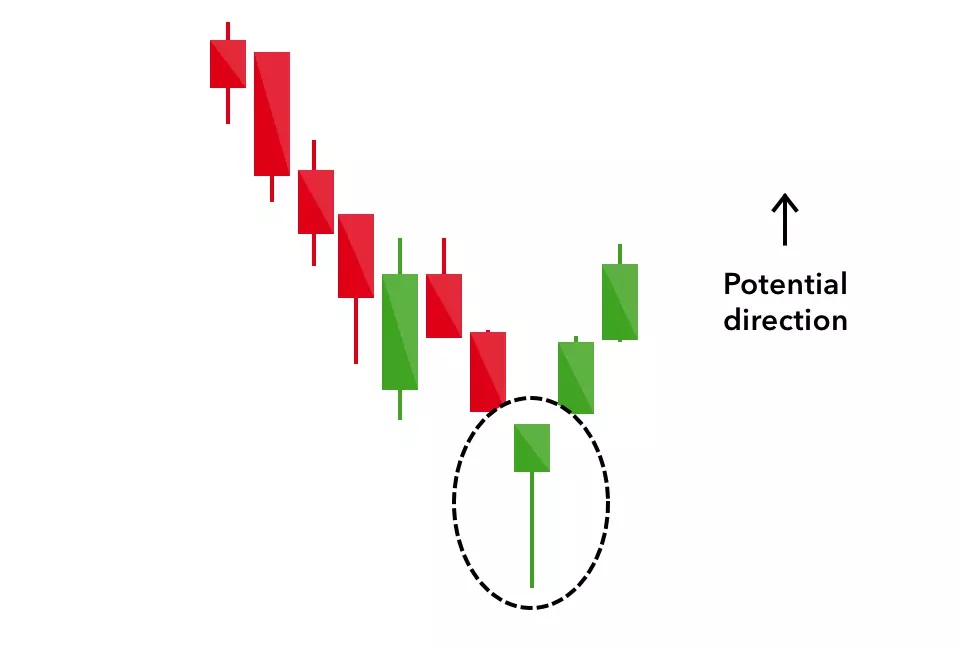

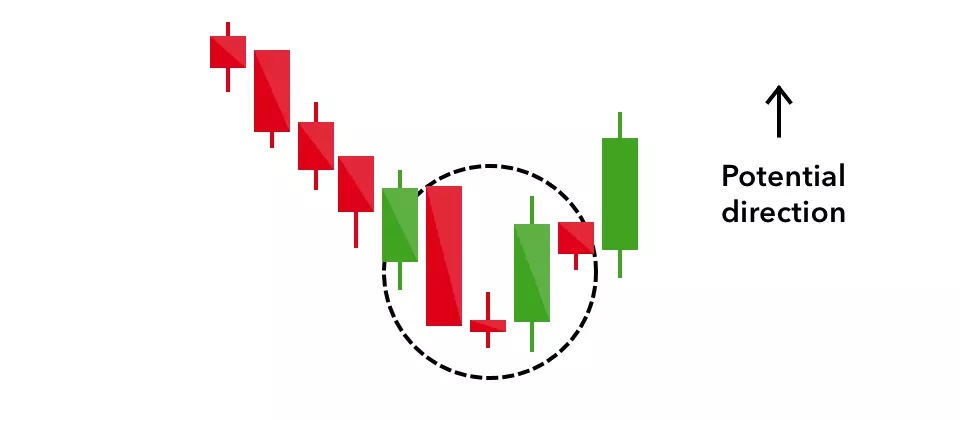

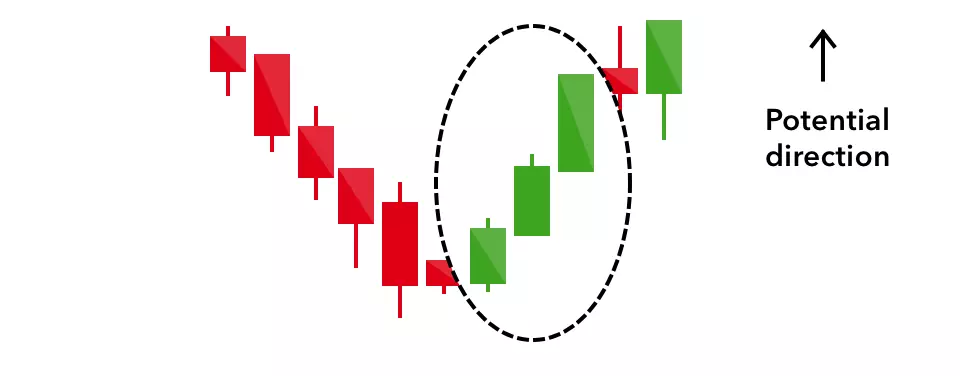

Morning star

three-stick pattern: one short-bodied candle between a long red and a long green.

It signals that the selling pressure of the first day is subsiding, and a bull market is on the horizon.

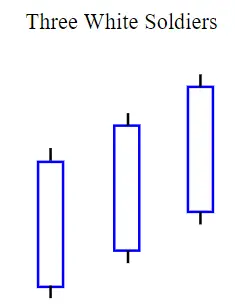

Three white soldiers

strong bullish signal that occurs after a downtrend, and shows a steady advance of buying pressure.

Six bearish candlestick patterns

Hanging man

The hanging man is the bearish equivalent of a hammer; it has the same shape but forms at the end of an uptrend.

The large sell-off is often seen as an indication that the bulls are losing control of the market.

Shooting star

The shooting star is the same shape as the inverted hammer, but is formed in an uptrend: like a star falling to the ground.

Bearish engulfing

A bearish engulfing pattern occurs at the end of an uptrend. The first candle has a small green body that is engulfed by a subsequent long red candle.

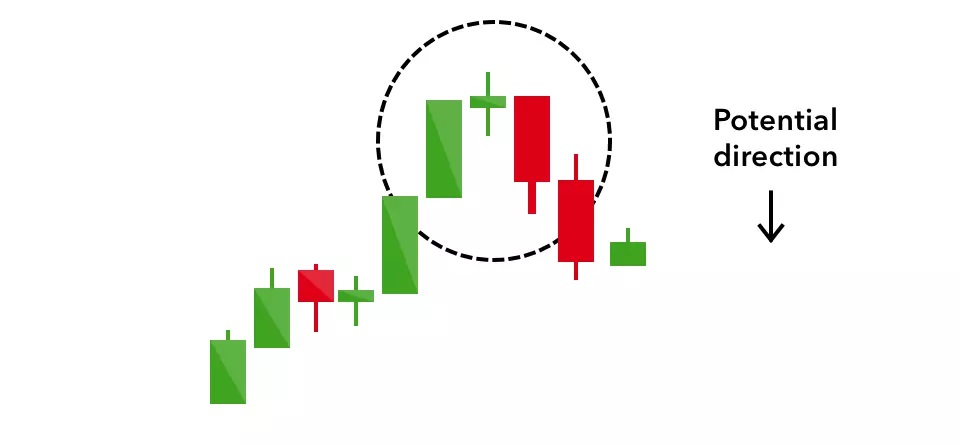

Evening star

The evening star is a three-candlestick pattern that is the equivalent of the bullish morning star. It is formed of a short candle sandwiched between a long green candle and a large red candlestick.

It indicates the reversal of an uptrend, and is particularly strong when the third candlestick erases the gains of the first candle.

Three black crows

three consecutive long red candles with short or non-existent wicks. Each session opens at a similar price to the previous day, but selling pressures push the price lower and lower with each close.

sellers have overtaken the buyers during three successive trading days.

Dark cloud cover

bearish reversal – a black cloud over the previous day’s optimism. It comprises two candlesticks: a red candlestick which opens above the previous green body, and closes below its midpoint.

Four continuation candlestick patterns

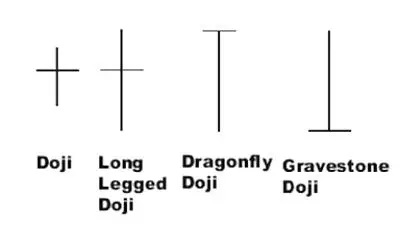

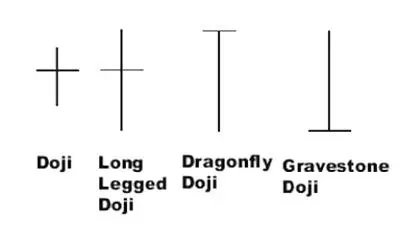

Doji neutral signal,

This doji’s pattern conveys a struggle between buyers and sellers that results in no net gain for either side. Alone a doji is neutral signal, but it can be found in reversal patterns such as the bullish morning star and bearish evening star.

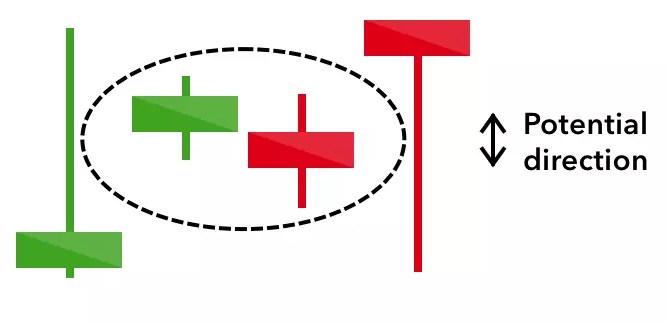

Spinning top

Spinning tops are often interpreted as a period of consolidation, or rest, following a significant uptrend or downtrend.

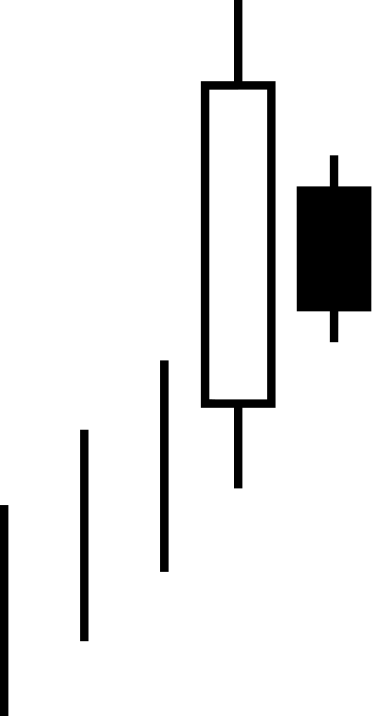

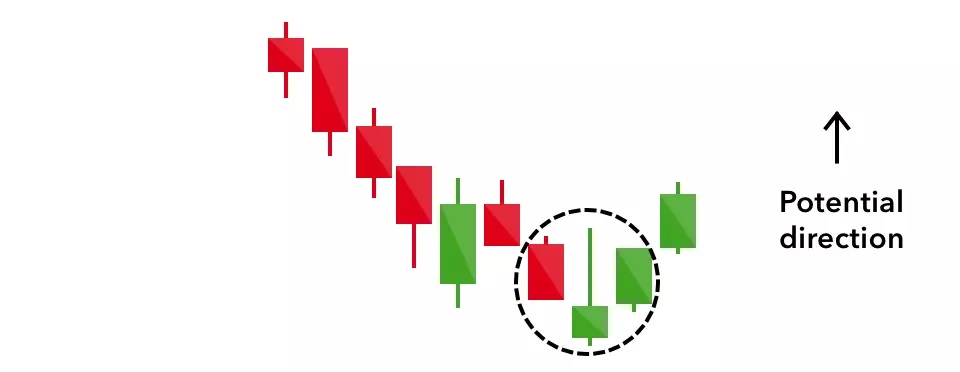

Falling three methods

Three-method formation patterns are used to predict the continuation of a current trend, be it bearish or bullish.

The bearish pattern is called the ‘falling three methods’. It is formed of a long red body, followed by three small green bodies, and another red body – the green candles are all contained within the range of the bearish bodies.

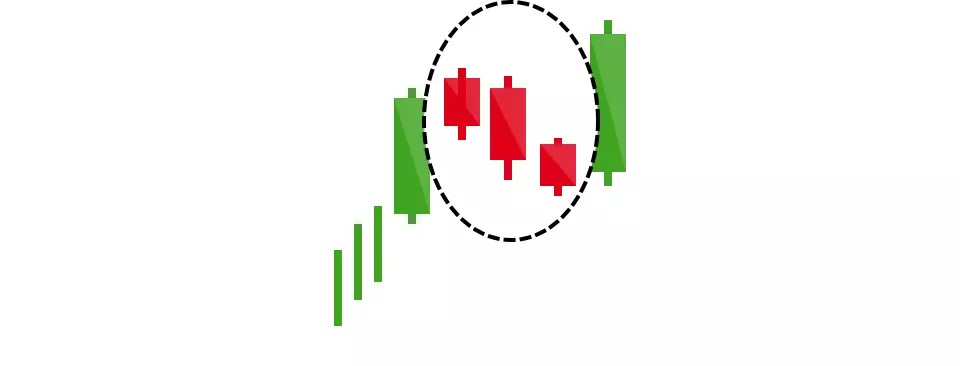

Rising three methods

The opposite is true for the bullish pattern, called the ‘rising three methods’ candlestick pattern. It comprises of three short reds sandwiched within the range of two long greens. The pattern shows traders that, despite some selling pressure, buyers are retaining control of the market.