basically i am follower his youtube channel, his videos philosophy different from other traders. fundamentally oriented and contrarian type.

lets dig his investment style and learn from him.

Purpose this article: to pull his content ideas at one place for better understanding.

About Vivek SInghal :

sebi registered person & earned crores and youtber, trainer

How he Made crores+?

His father business buy wheat on season and sell on season, 3x Profit, buy at 150 sell at 450 in a year.

Same approach applied in stocks. buy fundamentally strong companies at lowest price (no problem in business & financial but in technical), buy and average further 1-3, each stock upto 6% weightage minimum 20 stocks. no stoploss. investment horizon 1-3 years (short term cycles bull, bear and consolidation in NSE). 10 years long term cycle.

1.Best Technical Indicator by Vivek Singhal

Each Stock has different behavior in technical charts, (cyclical, growth, defensive etc).

company at all time high but business is not good, it will fall regardless of technical indicators. its a good company then stock fall then it rise because of value buying.

advised to use technofunda strategy.

The Best Technical Indicator is

- Business growth: Is there is any demand for business.(product/ service).

- Financials: highest ever sales & revenue (net profit).

- Technical: check History correction Percentage large cap 20%, mid cap

Company Posting Highest ever sales/revenue but there is correction.

Ex: ITC, SBI Card.

invest in 4 installments on every 5% correction.

video source

3 years double strategy paid course

choose fundamental strong companies,

buy 67% down from ATH.

Average it sell on 100% gain in 1 year or ATH.

2.World’s Best Trading Strategy NO Stoploss Strategy

buy companies expected to reach life time high, and 40% down from ATH. ex: MRF (demand from consumers)

Stoploss causes to lose money. instead of stoploss diversify portfolio minimum 20 stocks each 5%. then 5% automatically act as stoploss.

Twitter: https://twitter.com/theviveksinghal

https://www.screener.in/user/575509/

3. Moving Averages swing trading Strategy (contrarian approach)

Buy : When Stock closing Price Below 20, 50, 200 EMA

Sell: When Stock Price above 200, 50, 20 EMA

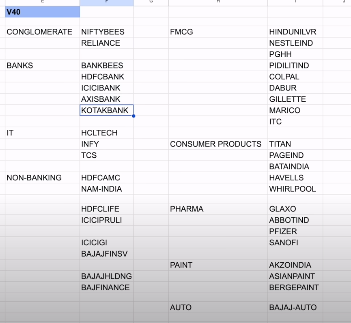

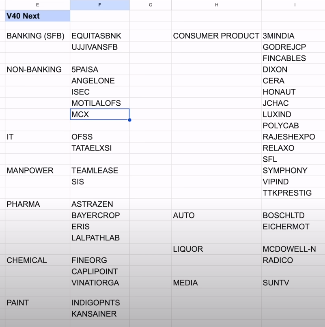

opposite to other recommendation. but value buying in Strong fundamental stocks named as V40 just like nifty 50.

4. Best Selling Strategy For Huge Gains – Vivek Singhal

type of stocks in Portfolio stocks 3 types

Bad shares

by mistake bought, bought by recommendation.

sell on bull run or anytime.

All life time High Before Nifty

sell on ATH+20% gain (ride till the trend bends – by traders, )

All life time High after Nifty

Sell on ATH

don’t need to sell before ALL time high, Patience needed to see green in portfolio for 1-2 years, just like red in previous years.

source: here

5. Best Method To Average A Stock – Complete Explanation

when buying: Business growth, financial growth, main company in the industry.

after is available at good price. after taking a position, price may fall further,

Company problem:

Selling pressure: FII, DII , Shareholder selling due to their reasons

ex: Industry problem: IT companies lagging behind nifty 50 due to weak profit margins.

Market problem: profit booking etc

Buying reasons:

5% gain, 10% gain, 20% or 40% gain.

5% gain target in 1 month.

same day fall no buy. next day upto 3 at (2-3% correction) upto 4 installments.

10% gain 1-3 months

buy on next week.

20% gain 6 months.

Average in next month.

40%+ gain

monthly averages

source here

6. How to find great companies in 5 minutes with screener

Return on capital employed > 25 AND

Debt to equity < 0.20 AND

Net profit preceding 12months > 300 AND

Net Profit latest quarter > 75

2nd query

Return on capital employed > 30 AND

Debt to equity < 0.10 AND

Net profit preceding 12months > 500 AND

Net Profit latest quarter > 100

https://www.screener.in/screens/592166/trading-with-vivek/

video link

2 Best Swing Trading Strategies | Class 3 of My Online Paid Course for Free

v20 strategy

- 3% each stock

- there is no stoploss

- there should be bunch of green candle(1 or 1+) with 20% gap from low to high on daily chart. ( go to indicators and search “20% up with all continuously green candle”, you dont have to find it manually, it will automatically highlight the part)

- marks the upper & lower lines.

- we buy low and sell on higher line.

- in v200 companies not applicable above 200day Moving Averages. but v40, v40next no rule of this.

- v200 companies below 200SMA.

Averaging:

1 stock 6%, each trade 3%. 2 trades in 1 stock.

knoxville divergence … continue..

3 Times in 3 Years Strategy by Vivek

1. 67% Drop from All time high

2. Reason for fall

2.1 categories

a. sales down and because of this Net profit then stock price.

b. Sales is ok, Net Profit down because then Stock price down (Inflation, Asian paints)

c. Sales was ok NPM Ok Only Stock Price down (sentiments)

3. reason of the shouldn’t exit any more..

ex: inflation cool off.

4.There should be proven track record of good performance in the past.

5.There should be an improvement in latest quarter results.

6. there should be a good future prospects produts/ services.

(ex: hul, electricity, mutual funds, india per capita income grows)

7. after meeting above 6 conditions stock price still be down by 50%_ down from ATH.

8. we buy after buying these conditions.

9. sell after reaching 100% gain within 12 months..

10. if there is no 100% gain within 12 months then sell at Life time High.

11. if not lucky then all are above waste..

3 reasons: Business, financials, Technical

link of video

7 Trading Secrets – For 100 Crore

link of video

- not watch tv watch only business , financial , technical analyzes.

- no every day Profits: Successful traders not understand stocks like FD,

- Market fall with Bad news – we must buy good stocks based technofunda by keeping news in mind.

- NO Trade on loan, NO fno before success in equity trade. invest the money no need of 3 years .

- Proper trading plan , 5-10% allocation, minimum for 3 years.

8. How To Use Price Earning Ratio – A Complete Guide

difference view on PE, rather than traditional pe ratio price/earning.

400 PE equal to 40 PE.

comparing PE to Peer industry

Mean PE 13.7

HDFC 15PE

PVT banks to PSU banks (equal to PVT banks valuation gap filled).

PVT banks not fall but their earnings increased.

TAnla Platform fast growing because of growing revenue.

Sector it software >> industry – computer medium/small

mid cap to mid cap comparison.

LOw PE industry refineries

Crude oil & government duty uncertainty.

Adaniwilmar PE 356

2 quarters negative due to govt regulation palmoil Russia ukrain war. temporary industry problem, avg quarter net profit 200 crores.

4500(market cap/800(Net profit) = 56PE (actually how).

Page industries

profits declined in 2 years. from average 200 crores to 150 qoq, yoy comparison

PE 75, if we took average earnings as TTM 800 crores and divide market cap then it will be PE 55.

UPL Limited 0 PE due 2 quarters loss world 4th largest seed maker.

bought another seed company in the 2 quarters.

if we take last 2 years avg 4000 crores and market cap 36000 crores 8PE, 10 years median PE 10+.

forward PE uses forecasted earnings for the P/E calculation. no 5%+ stocks.

9.Best Strategy to Trade in 2024

2024 will rally, most companies are in consolidation in 2023 asian pains, hul, hdfc etc.

don’t do random trading by picking uptrend stocks.

1.Latest quarter results higher ever revenue & profit.

2.PL Statement: 10 year long term growth in revenue, profit etc

ex: tanla platform, lalpath labs

3.Business analysis:

market leading company.

4. strategy based above 7 strategies.

5. don;t invest more than 5% in stock.

10. Master Class for Traders – Vivek Singhal

1. company price low it doesn;t mean company bad, higher price means company good

2.we are not hero: buying not bottom selling on top no one ever predict

3. greed over invest in 1 stock

4. borrowed money not regular income avg income

5. we should have to rely up on the financials of the company (they may not true) scams) & 5% investment in one stock

6. 30% every year not but 30% CAGR in 10 years..

7. weekend entertainment & spend stock market very good return not a good idea.

8. Small cap higher return & risk, but expecting higher return & lower risk.

11. 99.99% Winning Rate Swing Strategy – Vivek Singhal

Buy on 52 week low sell on All time High.

20 companies 5% each, apply on strong fundamental companies v40 and v40next.

12. Best 80 Companies – V40 and V40 Next | Best Stocks to Buy Now

Based on 6 rules

- Market leader

- almost debt free

- 10-15 years of business (5-6 companies with high growth)

- future prospects 10+ years

- brand power , pricing power

- No govt companies (not business aggressive) no pvt companies in their sector.

Size in small cap and industry leader v40 next.

Note companies can be outdated based on above parameters.