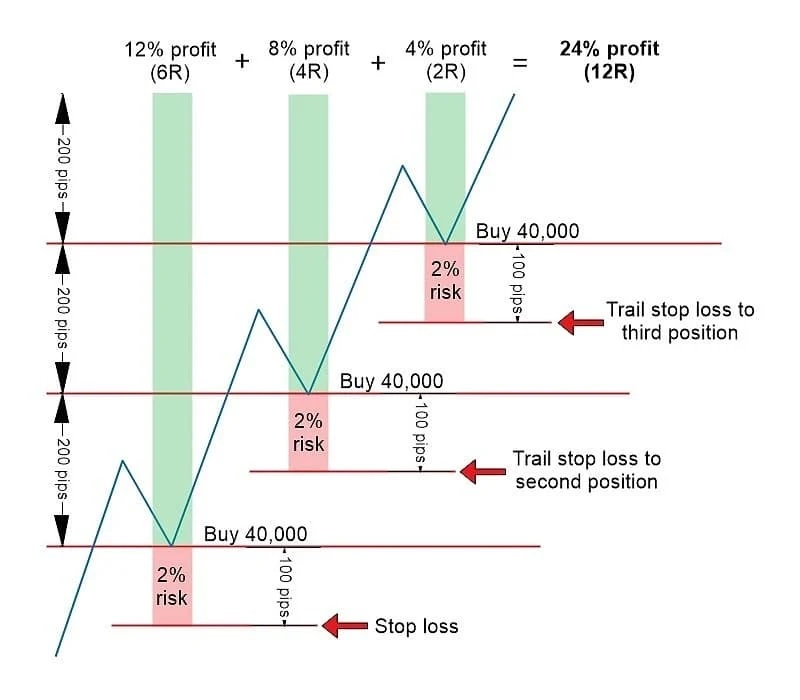

Pyramiding is a position sizing technique in trading that involves gradually increasing the size of a position as the price of an asset moves in a favorable direction.

As you can see from the figures above, the worst case scenario at any point in the trade is a 2% loss, while the best case

scenario is a 24% profit.

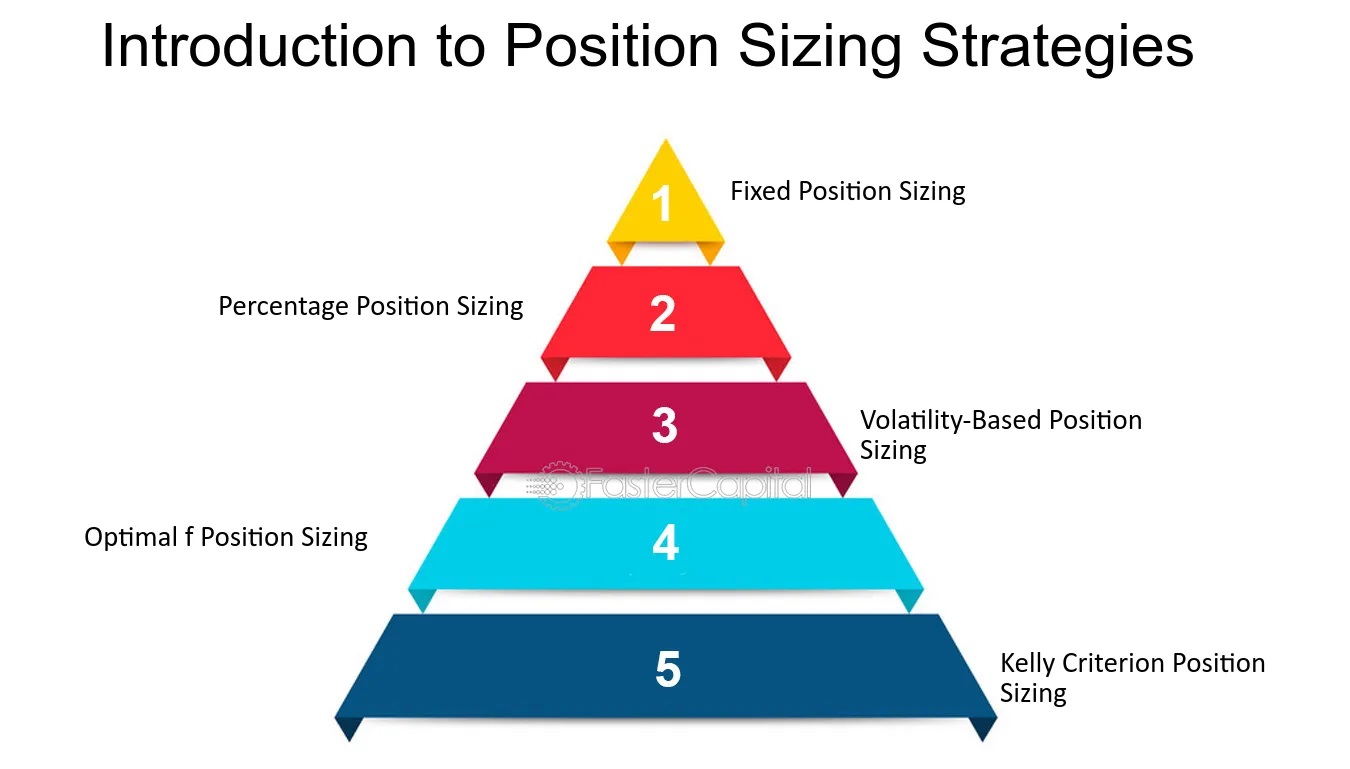

position sizing strategies

- A. Capital-based Fixed dollar value

- B. Risk-based Fixed percentage risk per trade

- Kelly Criterion position sizing

- Leverage

- Contract size value

Kelly Criterion position sizing formula

kelly % = W – [(1-W)/R]

Where,

W = Winning probability

R = Win/Loss ratio.

What is pyramiding position sizing?

The term ‘pyramiding’ refers to the adding of positions to an existing holding as the share price moves in the direction of the current trend. For pyramiding in bullish market environments this means adding positions as the price continue to rise.