SLEEP Frame work

- S Selection of Stock based on Techno & fundamentals.

- L Level Headed Mindset – Staying disciplined and emotionally stable.

- E Entry Timings: Mostly Technical parameters price actions & indicators.

- E Exit Timing Mostly Technical parameters price actions & indicators.

- Portfolio Sizing: How large a portfolio and how may stocks.

Selection of Stock

- Select stocks from running(uptrend) sector / themes.

- fundamental: Select socks with strong with fundamentals – Piotroski score (Ad growth , FII and DII , Promoter holding etc ROCE etc)

- Technical: Stocks with 15% range from all time High (exit when it below)

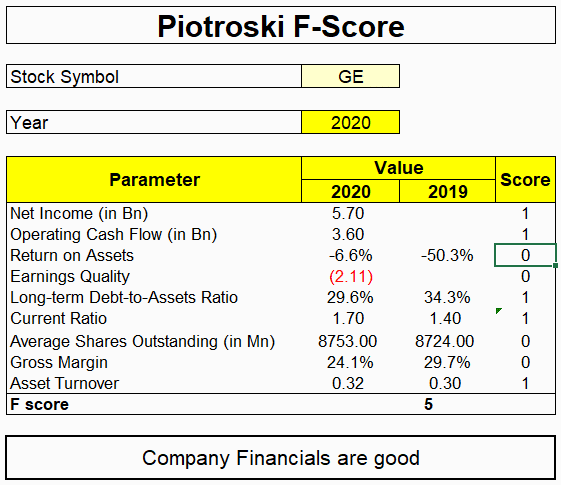

Piotroski score Model

Profitability

Net income >0

(CY)Current year ROA> Previous Year ROA

Operating Cash Flow >0

Operating Cash Flow > Net Income

Leverage & Funding

CY Long Term debt < PY Long Term Debt

CY Current Ratio > PY Current Ratio

No Equity Dilution

Operating Efficiency

CY Gross Margin>PY Gross Margin

CY Asset turnover ratio> PY Assest turnover ratio

Timing the entry

- Market momentum

- retracement from high to near support bases. (retracement levels based on RSI Indicators)

Timing the exit

Fixed SL: 7-10% from entry

Trailing Stop Loss: Stock Price Fall from 15% Below from All time High ATH Price.

Stock Falling into Bearish zone breakdown.

Screening stocks through Screerner.in PAPA Entries

Current price > High price all time * 0.85

AND

Piotroski score > 7 AND

Profit growth > 15 AND

OPM > 15 AND

Market Capitalization > 100 AND

Market Capitalization < 20000 AND

RSI > 50 AND

RSI < 65 AND

Return over 1day > 0

TIP: Pretax income in trading view price & earings co relation. also use RS Indicator.

milind upasani books recommendations

- How to Make Money by in stocks– William o neil. vey nice for beginer CANSLIM model

- Trade like a champion & Trade like a stock Market wizard by Mark minervini

- secrets of profiting in bull and bear markets by Stan Weinstein

- Technical analysis of financial markets -jhon murphy

- buy and sell signals – steve burns

- Moving averages 101- steve burns

- secrets of profiting in bulls and bear market – stan winstein

- how i made 2 million in stock market nicolas darvas box model

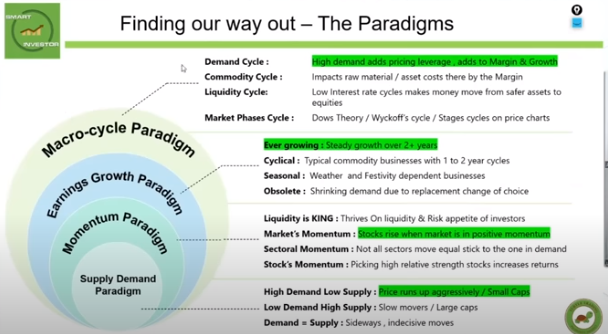

The Paradigms boring part

Macro cycle paradigm

- Demand

- Liquidity

- Market Phases

- Commodity

Demand Cycle:

demand drives the revenue of the business. when it gets far beyond the supply in the market as well as there are less players in the market it helps improve the margins.

commodity cycles:

price of commodities vary frequently due to variation in supply side and demand side constraints. it impacts the margin directly due to impact on raw material prices.

liquidity cycles:

central banks are playing balancing act between growth and inflation by controlling fund flow in the market influenced by interest rates, higher interest rates move the money from high to lower risk assets & vice versa.

Market phases of individual stocks:

price of stocks move in cycle of risk to safety levels depending business performance, liquidity. we depicted in Dows theory of market phases.

Earrings growth paradigm

Ever Growing Business:

These are business with multi year growth and earnings visibility.

example – green energy, defense, railways, capital goods.

Cyclical Business:

Businesses where earnings and growth is visible for mid term 0 2/3 quarters.

examples: metals, tea, coffee, crude, gs

Seasonal Business:

business where earingins and growth varies on quarter to quarter, weather, festivity, event dependent,

example: sugar, fertilizer, clothing, footwear, white goods, air conditioners, etc.

De growing businesses:

Business which are having negative growth outlook or getting obsolete. technology dependent /crowded ex: mosaerbeer CD mfg business, Food QsR competition from unorganized players for pizza players.

Momentum Paradigm

Cash is KING

Nothing moves in Market without people having extra cash in hand whch adds to their risk taking ability. market moves when interest cycles slow down or recede.

market momentum:

second best indicator that people are investing and ready to take risk. if market in downtrend stocks are at risk to get into downtrend. probability of breakout failures is very high. trade only when markets are in uptrend/momentum.

sectoral momentum:

different sectors move at different strength and if difference direction. probability of profits improve only when you allocate to the up trending momentum sectors.

stocks in momentum:

every sector has leaders and laggards within them one needs to focus on winners within winning sectors to make faster gains.

supply demand Paradigm

high demand low supply:

if buyers are excited to sell but sellers are interested to hold.. price of the stock will rise very fast. these stocks are the best one to buy and hold.

low demand high supply:

if sellers are afraid and buyers not interested in buying. stock price crashes very fast .. these stocks are an avoid.

demand = supply:

when market participants are not sure about prospects of a stock the stock goes sideways in indecisive phase. these stocks are good to keep in watchlist for each such phases to lead to explosive move on either side..

References:

milind upasani twitter: https://twitter.com/Milind4profits

milind upasani youtube channel(learn2invest) : https://www.youtube.com/@milind4profits

milind upasani screener: https://www.screener.in/user/22596/

https://www.screener.in/screens/980972/milind-upasani-papa-scan-entries/

https://chartink.com/screener/watchlist-turtle-buy-by-milind-upasani

https://www.elearnmarkets.com/expert/milind-upasani