What is Central Pivot Range (CPR)?

The Central Pivot Range (CPR) is an indicator to identify key price points to set up trades. CPR is beneficial for intraday trading.

Before you understand the CPR, it is important for you to know the Support and Resistance;

how cpr works?

CPR indicator comprises 3 levels. The pivot points at the top and bottom of these levels are the primary pivot points and the central pivot. it helps to locate the crucial price level breakthrough points.

How to calculate CPR?

stock’s lowest, highest, and the closing levels from the previous trading day.

(Low + High + Close) / 3= Pivot point

• (BC – Pivot) + Pivot= Top CPR Point (BC)

• (Low + High) / 2= Bottom CPR Point (TC)

Pivot

Bottom Central Pivot (BC)

Top Central Pivot (TC)

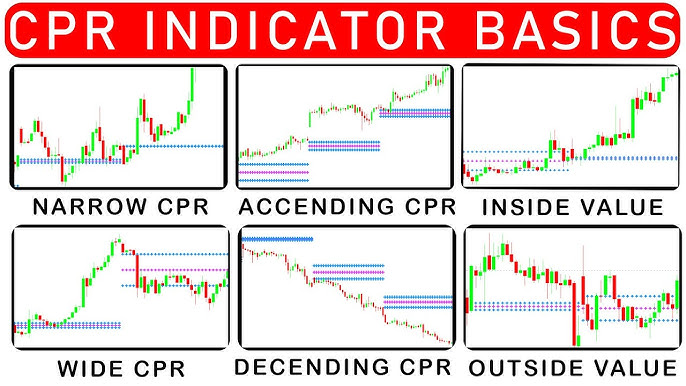

Central Pivot Range interpretation?

indicates a stock is in a bullish or bearish trend.

CPR line is creating an ascending or rising trend, a bullish-like approach is suggested.

2. Conversely, a down trend in a CPR line suggests a bearish-like approach.

Virgin CPR

The CPR is considered virgin when stock price doesn’t cross these CPR lines. If a stock’s price doesn’t hit the range on its previous day, there is a 40% probability that it won’t be able to breach this CPR range the next day. It is significant to remember that, rest on the state of the market, the virgin CPR might act as powerful resistance or support.

Price trading above the Top Central Pivot (TC) level

The buying trend enables the traders to buy a stock when its average price lies on its upper side as indicated by a higher price compared to the TC level. CPR would operate as the support in this scenario.

Price trading below the Bottom Central Pivot (BC)

level

A seller’s market is present when the price is comparatively lower than its Bottom CPR range. It suggests that there are lots of buying chances in a negative market. Moreover, CPR will serve as resistance.

Price that is trading in the Central Pivot Range lines

When its current price moves back and forth between CPR lines, the stock market is operating in the accumulation period. In such a scenario, traders might watch for the CPR breakthrough with a volume above TC. When there is a wider CPR, the best approach is to purchase at the intended top central pivot point (TC) while maintaining the bottom CPR point.

refeences:

All you wanted to know about Central Pivot Range (CPR) Indicator