Sector Rotation Strategies

Cyclical v/s Defensive:

Cyclical sectors, like technology and consumer discretionary, tend to do well during economic expansions, while defensive sectors, like healthcare and utilities, may outperform during economic contractions.

Relative Strength: select sectors based on their recent performance relative to the broader market or other sectors.

Economic Indicators: such as GDP growth, employment data, and manufacturing output to and interest rates.

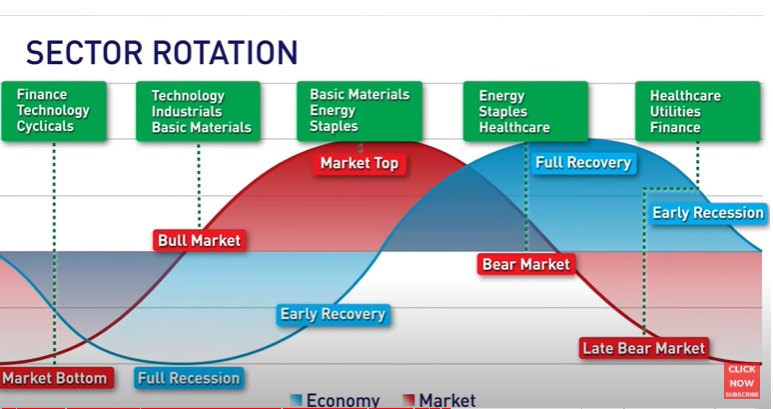

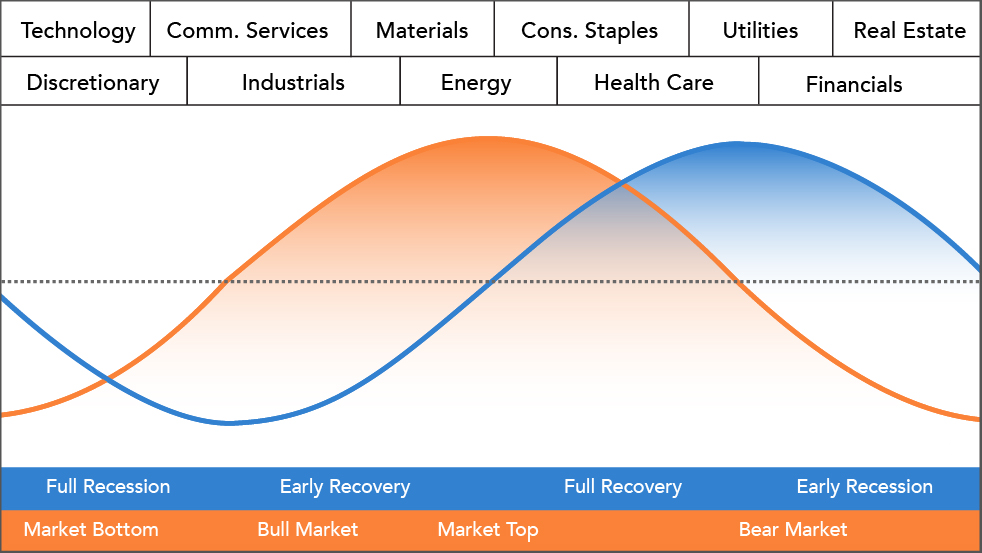

sector rotation and economic cycle

Changes in the Market Cycle

• Changes in the Economic Cycle

• Overbought vs. Oversold Cycles

The Market Cycle moves ahead of the economic cycle

| Cycle Stage | What Happens | Sectors to Rotate Into |

|---|---|---|

| Market Bottom | Systemic risk resulting from a poor economic backdrop brings the whole market lower. Investors prepare to rotate into more economically sensitive sectors. | Communication Services, Consumer Staples, Health Care, Technology, Utilities |

| Bull Market | The market bottom has passed, and the worst is over. As economic activity picks back up, so do the share prices of cyclical stocks. | Consumer Discretionary, Energy, Industrials, Materials, Real Estate, Technology |

| Market Top | Economic growth overheats, and interest rates rise. Investors prepare to rotate into more “defensive” sectors that are less economically sensitive. | Communication Services, Financials, Materials |

| Bear Market | Markets begin to drift from highs, and economic activity slows. As investors rotate out of cyclical sectors into defensive ones, selling activity accelerates the market decline. | Consumer Staples, Health Care, Utilities |

The Economic Cycle lags behind market movements

| Cycle Stage | What Happens | Best Performing Sectors |

|---|---|---|

| Full Recession | Falling GDP, Falling Production, Pessimistic Consumer Sentiment, Deflationary environment, Falling Interest Rates, Normal Yield Curve | Consumer Staples, Health Care, Utilities |

| Early Expansion | Rebounding GDP, Increased Production, Optimistic Consumer Sentiment, Reflationary environment, Low but Stable Interest Rates, Steepening Yield Curve | Communication Services, Consumer Discretionary, Industrials, Materials, Real Estate, Technology |

| Late Expansion | Tapering GDP, Tapering Production, Strong Consumer Sentiment, Growing Inflation, Spiking Interest Rates, Flattening Yield Curve | Consumer Discretionary, Energy, Financials, Materials |

| Early Recession | Declining GDP, Declining Production, Weakening Consumer Sentiment, High Inflation, Tapering Interest Rates, Flat or Inverted Yield Curve | Communication Services, Consumer Staples, Health Care, Utilities |

Overbought and Oversold Cycles RSI 30, 70 and 50 day SMA and 200 day SMA

50 day EMA Crosses 200 day EMA then its may uptrend. when it also combines with RSI indicator it good confirmation.

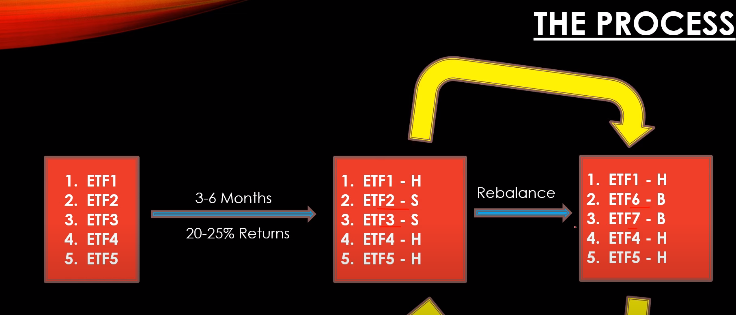

Sector rotation etf strategy

Target 20-25% Profit

Allocation 10% of portfolio

not more than 5 ETFs or index. 3 is better

Identifying breakout sector

Macroeconomic trends, industry developments and regulatory changes that impact the sector performance.

Websites to scan sector performance ex: stockedge

daily scan ATH & 52 week high stocks, then check the other stocks in sector,

-

earning estimate sustenance