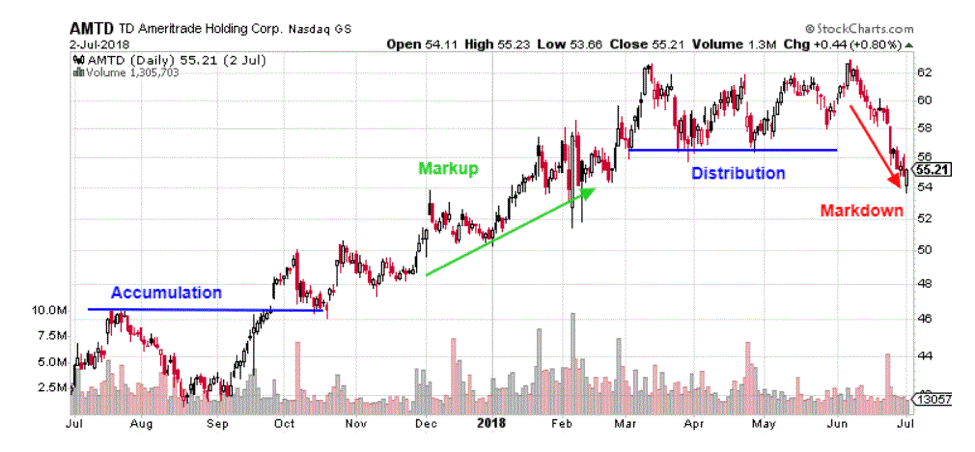

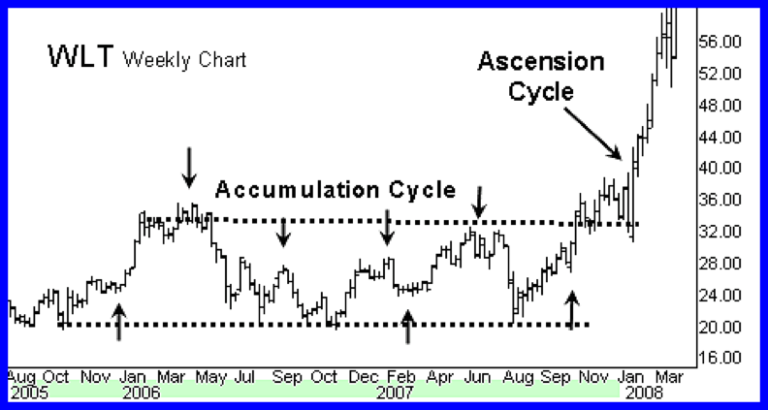

Richard Wyckoff, a prominent trader and pioneer in technical analysis, developed a buy-and-sell stock cycle that occurs over four distinct stages:

- Accumulation / breakout

- Markup / uptrend

- Distribution / consolidation

- Markdown / downtrend

Investors measure a stock cycle by comparing the distance between lows to help determine where prices are in the current cycle.

Note: blended moving averages personally, you can also mix. check on monthly charts identify better.

Accumulation:

An uptrend starts with the accumulation phase. This is where institutional investors slowly begin acquiring large positions in a stock. use support and resistance levels to find suitable entry points at this stage of the stock cycle.

Screener FII Activity

https://www.screener.in/screens/646576/fii-and-dii-activity/

(Change in DII holding > 0.1 AND

Change in FII holding > 0.1 ) AND

Debt to equity < 0.9 AND

NPM latest quarter > 5

or

Change in FII holding > 1 AND

Change in DII holding >1 AND

Market Capitalization > 500

- After long consolidation

- breakout from the base

2nd stage Markup / growth / peak:

A breakout of the accumulation period starts the markup cycle. Trend and momentum investors make the bulk of their gains during this phase, as a stock’s price continues higher. In this part of the stock cycle, traders use indicators, such as moving averages (MA) and trendlines, to help make investment decisions. For example, an investor may buy a stock if it retraces back to its 20-day moving average.

- Price above 200, 100, 50, 20 DMA

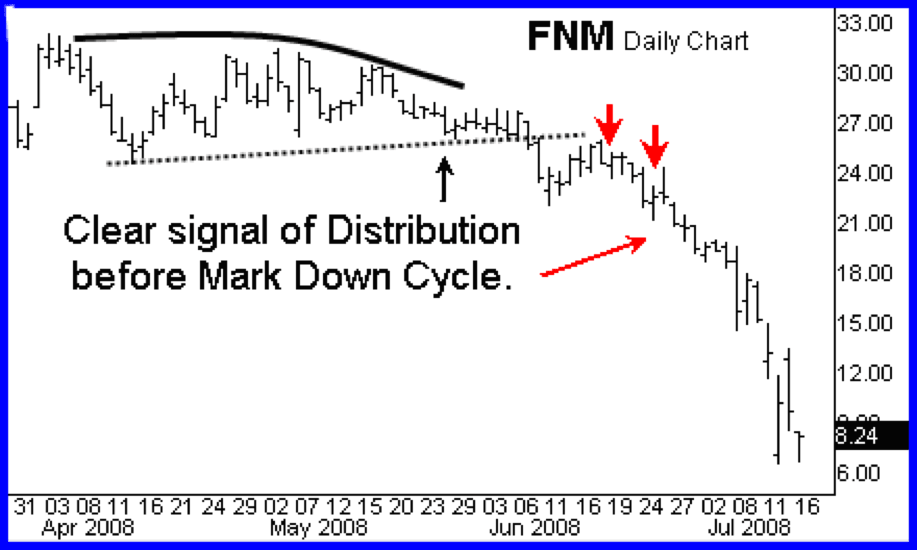

Distribution /topping /sideways /consolidation:

Institutional investors start unwinding their positions at this stage of the stock cycle. Price action begins to move sideways, as the bulls and bears fight for control. A bearish technical divergence between a stock’s price and technical indicator often starts to appear in the distribution phase.

- price breaking below its 200 days moving average.

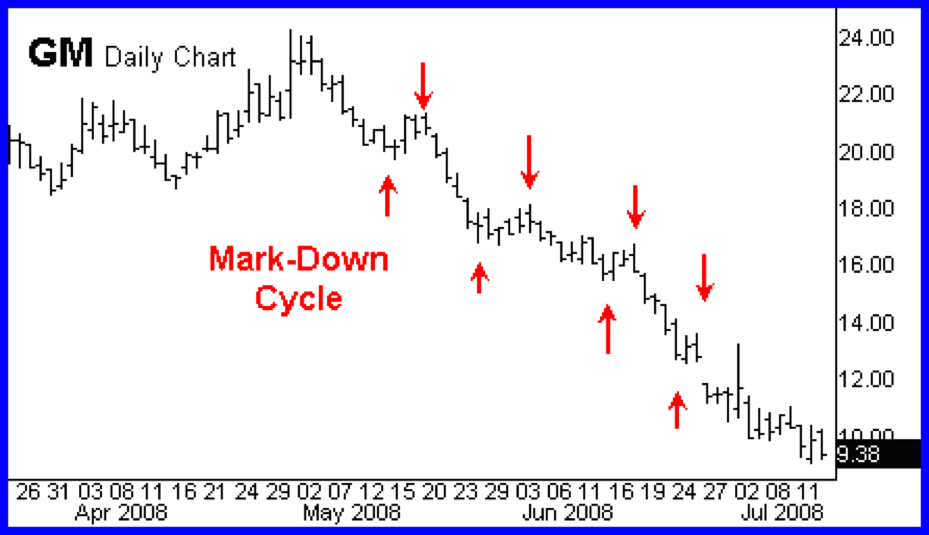

Markdown / decline:

Volatility often increases during this phase, as investors rush to liquidate their positions. Investors use temporary retracements to the upside as an opportunity to sell their shares, while traders look to open short positions to take advantage of falling prices. Typically, margin calls increase near the conclusion of the markdown cycle, as stock prices near their lows,

Signals:

- 200 DMA

How to Make Money in Stocks: A Winning System in Good Times and Bad,

by William O’Neil

As per dow theory we can modify as below but you can try yourself

1. Short term trends

The duration of the trend lasts for o days to 3 weeks. We can use 20 DMA or a combination of 4, 9 and 18 DMA.

1 month

2. Intermediate trend

This trend lasts for a period of 3 weeks to 3 months. Some people call it a secondary trend. We can use the combination of 13, 30 weeks SMA.

3 months

3. Long-term trend

Any trend that lasts for a period of 6 months or above, this is called the long-term trend., To understand the direction of the long-term trend, we can use 50 and 200 MA (days).

6 months

Disclaimer: its just a theory.