Simple Return

The Simple Return can be calculated with the following formula:

later Value minus Initial Value /Initial Value *100

Suppose you invested in a scheme, when its NAV was Rs 12. Later, you found that the NAV has grown to Rs 15. How much is your return?

= [ (15 – 12) / 12] * 100 = 25%

Annualized Return

The annualized return can be calculated as

Simple Return * 12 / Period of Simple Return (In Months)

Continuing with the same example, if the Simple Return is achieved in, say, 8 months, the annualized return would be :

= (25% * 12) / 8 = 37.50%

Compound Return

What is compounding? Suppose you place Rs 10,000 in a bank fd 3 years 10%

Mutual funds are not permitted to promise any returns unless it is an assured returns scheme. Assured returns schemes call for a guarantor who is named in the offer document.

Types of Risks Associated With Mutual Funds

- Market Risk (variety of factors ex: iran vs US, china & US trade war etc)

- Concentration Risk (focusing on one /sector)/ company

- Interest Rate Risk (debt schemes low rate unable to pay interest rate)

- Liquidity Risk (unable to sell /cash in in right time)

- Credit Risk ( companies not willing to pay especially in debt schemes)

Portfolio Risk

This is related to performance of the assets in the portfolio, but there is no certainty regarding the performance of the selected assets classes by the fund manager.

Portfolio Liquidity

If assets lying in the portfolio is Liquid, profits can be booked when required.

SEBI has laid down criteria to identify illiquid investments, and also set a ceiling to the proportion of such illiquid investments in the net assets of a scheme.

The ceiling is lower for open-ended scheme, which have a greater need for liquidity because investors can offer their units for re-purchase at any time.

Liquid assets in the scheme :

Two reasons to keep liquidity.

They believe that the market is over-heated, and therefore prefer to sell their investments and hold the proceeds in liquid form, until the next buying opportunity comes up.

They want to provide for contingencies such as impending dividend payment or re-purchase expectations.

Higher the liquid assets in the scheme, lower is the return of the scheme but at the same time they protect the scheme from any distress sale of investments.

The outside liabilities need to be paid by a scheme, irrespective of the performance of the assets.

Outside liabilities add to the risk in a mutual fund scheme.

Until the expenditure is paid, it is a liability in the scheme.

The practice of taking liabilities beyond what is inherent to the normal business of a mutual fund scheme is called leveraging. Limits for the same :

A mutual fund scheme cannot borrow more than 20% of its net assets

The borrowing cannot be for more than 6 months.

The borrowing is permitted only to meet the cash flow needs of investor servicing viz. dividend payments or re-purchase payments.

Use Of Derivatives

It can be used for the purpose of

Hedging against risk

Re-balancing the portfolio

Mutual Funds are barred from writing options.

Unit Holders Churn

As a measure to protect the investor, SEBI has stipulated the 20:25 rule viz. every scheme should have at least 20 investors; no investor should represent more than 25%of net assets of a scheme.

Risk in equity funds

The real economy goes through cycles. For a few years until 2008, the economy was booming. Then things started changing. 2009 was gloomy. However, during 2010 an economic recovery is being seen.

In the long run, equity markets are a good barometer of the real economy – but in the short run, markets can get over-optimistic or over-pessimistic, leading to spells of greed and fear.

Equity markets therefore tend to be volatile.

Portfolio Specific

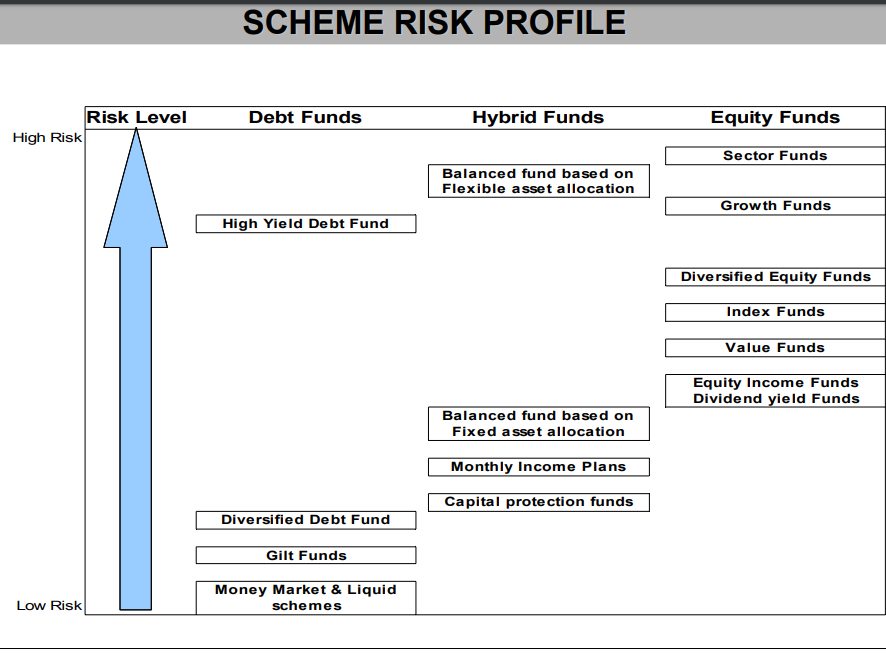

Sector Funds suffer from concentration risk – the entire exposure is to a single sector. Performance of the scheme will depend up on performance of one sector only.

Diversified Equity Funds, on the other hand, have exposure to multiple sectors. Diversified equity funds are therefore less risky than sector funds.

Thematic Funds are a variation of sector funds. It is discussed in Chapter 1.

Mid Cap Funds invest in mid cap stocks, which are less liquid and less researched in the market, than the frontline stocks. Therefore, the liquidity risk is high in such portfolios.

Contra Funds take positions that are contrary to the market. Such an investment style has a high risk of misjudgments.

Dividend Yield Funds invest in shares whose prices fluctuate less, but offer attractive returns in the form of dividend. Such funds offer equity exposure with lower downside.

Arbitrage Funds are categorized as equity funds. Risk is the lowest among equity funds – even lower than diversified equity funds. The returns too are lower – more in line with money market returns, rather than equity market returns.

Risk in debt funds

There is assured value on maturity, but debt securities fluctuate in value, with changes in yield in the overall market.

A fund manager taking a wrong call on the direction of interest rates can seriously affect the scheme performance.

Because of Illiquidity in Non – Government Debt Market, an element of subjectivity creeps into their valuation, and therefore the NAV.

Short maturity securities (lower modified duration) suffer lesser fluctuation in value, as compared to the ones with longer tenor (higher modified duration).

Fixed Maturity Plan’s (FMP) yield is relatively more predictable on maturity but in the interim, the value of these securities will fluctuate in line with the market – and therefore, the scheme’s NAV too will fluctuate.

If the FMP is structured on the basis of investment in non government paper, then the credit risk is also an issue.

Balance funds

Balance Schemes :

It is rare for both debt and equity markets to fare poorly at the same time. Since the performance of the scheme is linked to the performance of these two distinct asset classes, the risk in the scheme is reduced.

It can be based on (i) Fixed Asset Allocation (ii) Flexible Asset Allocation

Between fixed asset allocation funds and flexible asset allocation funds, the latter carry higher risk.

Monthly Income Plan (MIP) :

It seeks to combine a large debt portfolio with a yield-kicker in the form of an equity component.

In such a structure, it is possible that losses in the equity component eat into the profits in the debt component of the portfolio.

If the scheme has no profits to distribute, then no dividend will be declared.

Gold Funds

As an international commodity, gold prices are a lot more difficult to manipulate. Therefore, there is better pricing transparency.

Further, gold does well when the other financial markets are in turmoil. Similarly, when a country goes into war, and its currency weakens, gold funds give excellent returns.

These twin benefits make gold a very attractive risk proposition. An investor in a gold fund needs to be sure what kind of gold fund it is –Gold Sector Fund or ETF Gold.

Real Estate Funds

Valuation of real estate assets is highly subjective, since every asset is different

Problems :

Black money

Less liquid asset class

Transaction costs

Regulatory risk

Benefits of Real Estate Funds :

Gives dual benefit : Exposure in Real Estate and Liquidity of MF

Real estate funds are quite high in risk, relative to other scheme types. Yet, they are less risky than direct investment in real estate.

variance

It measures the fluctuation in periodic returns of a scheme, as compared to its own average return

MS Excel function of Variance is VAR

Standard Deviation :

It measures the fluctuation in periodic returns of a scheme in relation to its own average return.

standard deviation equal to root of variance

MS Excel function of Standard Deviation is STDEV

Variance and Standard Deviation are relevant to EQUITY and DEBT

Beta is a measure of Systematic Risk.

Beta of any Index will always be 1.

Beta for particular security or portfolio can be 1, More than 1 or Less than 1.

Interpretation :

β = 1 — Return of security / portfolio = Market Return

β > 1 — Return of security / portfolio >Market Return

Aggressive security / portfolio

β < 1 –— Return of security / portfolio <Market Return

(Defensive security / portfolio)

This is relevant to EQUITY only.

Modified Duration :

measures the sensitivity of value of a debt security to changes in interest rates. Higher the modified duration, higher the interest sensitive risk in a debt portfolio

Weighted Average maturity :

Weighted average maturity of debt securities in a scheme’s portfolio is indicative of the interest rate sensitivity of a scheme

Relevant to Debt only.

Credit Rating:

The credit rating profile indicates the credit or default risk in a scheme

Government securities and cash or cash equivalents do not have a credit risk.

Corporate issuances carry accredit risk

Unsystematic risk / Specific Risk can be reduced through diversification.

Performance of the scheme is compared with Benchmark.

It should be in sync with the investment objective of the scheme

The benchmark should be calculated by an independent agency in a transparent manner, and published regularly.

In case of Index Funds, gaps between the scheme performance, and that of the benchmark, are called Tracking Errors. Or

The difference between an index fund’s return and the market return, as seen earlier, is the Tracking Error.

Index fund with least Tracking Error is the best.

Example of Benchmarks : Equity: S&P CNX Nifty, BSE Sensex Debt: Sibex, Mi-Bex, Li – Bex Gold: Gold Price

QQuuananttiittatatiiveve MMeasueasurres es ooff FFuunndd MMananagagerer PPererffoorrmmaanncece

Sharpe Ratio : Return Earned From Scheme – Risk free Return / Standard Deviation

if risk free return is 5%, and a scheme with standard deviation of 0.5 earned a return of 7%,

Sharpe Ratio would be (7% – 5%) ÷ 0.5 = 4%

Difference between Return from scheme and Risk free return is called Risk Premium

Sharpe Ratio is effectively the risk premium per unit of risk. Higher the Sharpe Ratio, better the scheme

Sharpe ratio is very commonly used measure of risk-adjusted returns

Risk-adjusted Returns :

Treynor Ratio : Return Earned From Scheme – Risk free Return / Beta

if risk free return is 5%, and a scheme with Beta of 1.2 earned a return of 8%

Treynor Ratio would be (8% – 5%) ÷ 1.2 = 2.5%

Alpha :

The difference between a scheme’s actual return and its benchmark return is called Alpha

Measure of the fund manager’s performance

Positive alpha is indicative of out performance by the fund manager