Exchange Traded funds (ETF) are open-ended funds, whose units are traded in a stock exchange.

In order to facilitate transactions in the stock market, the mutual fund appoints some intermediaries as Market Makers, whose job is to offer a price quote for buying and selling units at all times.

The authorized dealers can make more units available in the market to meet higher demand by getting units released by the mutual fund in the creation unit. They can also reduce the available units available in the market by getting units redeemed in creation units.

In a regular open-ended mutual fund, all the transactions by investors on a day happen at a single price. A key benefit of an ETF is that investors can buy and sell their units in the stock exchange, at various prices during the day that closely track the market at that time.

NOTE: Every mutual fund scheme should compare with index or benchmark. so it’s better to invest high yield scheme rather just an ETF or index funds (it reflects stock index /benchmark )

Index Funds Vs ETF

Both are Track Performance Of Index (Ex: NIFTY 50)

While Index funds are Mutual Funds. and ETF is Traded in Stock markets.

Both Index Funds & ETF’s Contains TOP 50 Companies in the Stock market Index. But Here You are Buying Through Mutual Fund House are Directly in the Share Market.

| Index Funds | ETF | |

| Broker Charges | Not Applicable | Broker charges apply when you buy or sell |

| Expense ratio | 0.5% | 0.1% |

| Tradability | end of the day | anytime |

| Buying | fraction | whole |

EXpense ratio: ETF Just like a Stock While Index Funds are Mutual Funds ( there are charges by Fund House, While ETF Charges for buying / Selling, Also look at Stock Trading charges.

Why Index Funds Not Recommended in Mutual Funds?

- Lowest Commission / Nearly No Commission for Agent

- Expense ration too Low for Fund House.

- No Active Trading (Buying/Selling) Expense ratio is low its passive trading option.

The Debate: Index funds Vs Active traded Mutual funds

Warren Buffet challenge (10 years any Mutual fund manager have to beat Index in US / S&P 500)

The challenge Accepted by a Fund manager.

In the Selected 5 Funds At least One Not Beaten The Index in America.

Indian Scenario:

Indian Sensex NIFTY 50 have 50 large CAP Companies.

1st argument: Someone urged on youtube But US S&P 500 has Mid & Small Cap Companies.

But the US Have

- S&P 500 large companies

- S&P 400 mid cap

- S&P SmallCap 600 Index

@2nd: The Stock market Index Not Reflects Indian Economy (while most Profitable companies Like Uber, Ila Flipkart Not Listed in the Stock).

Alpha >> performance of an investment against a market index.

For The Past 10 Years, Mutual Funds Beaten Nifty Index (Source Youtube)

3rd: Efficient Market Hypothesis

Indian markets are In Efficient because (Advantage/ Hedge over other investors due to lack of Infomation)

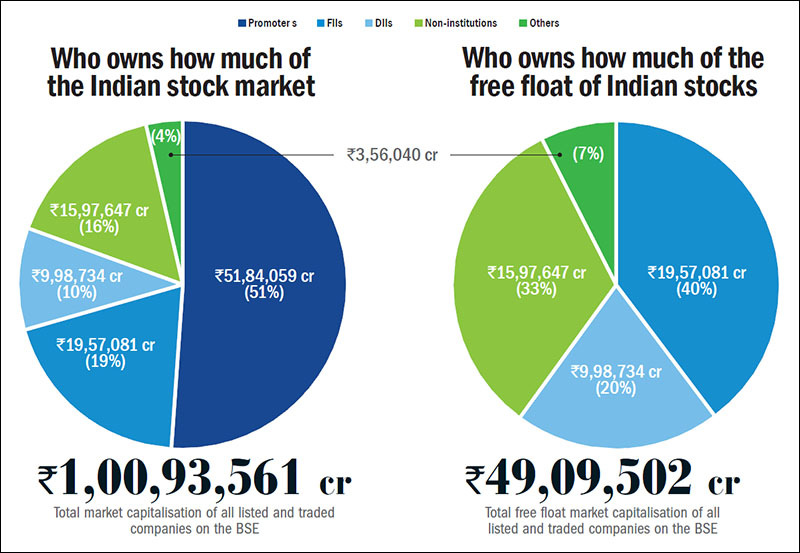

who owns the Indian stock market?

the above picture (after removing promoters) 40% of FIIs(Foreign Institutional Investors) investing indian stock market.

- Promoters >> 51%

- Domestic Institutional Investors or DII (banks, insurance companies, mutual fund houses, etc) 10%

- Foreign Institutional Investors or FII 19%

- Retail /non-institutional investors: 16%

- Others: Ex: NPS pension fund PPF, EPF, etc. 4%

Major Shareholders of Indian Stock Market

Index Funds & Active traded In past Years India.

SIP 1000 as on 2008

SIP Value at 31/12/2017

| Fund name | installment | Investment | SIP value | CAGR |

| Franklin Indian index fund Nfity | 120 | 12,00,000 | 21,55,888 | 11.27 |

| HDFC Index Nifty | 120 | 12,00,000 | 21,90,076 | 11.56 |

| SBI Bluechip Regular plan growth | 120 | 12,00,000 | 28,28,091 | 16.34 |

| Reliance large-cap growth plan growth option | 120 | 12,00,000 | 28,34,262 | 16.38 |

NIFTY 50 VS NIFTY 500

NIFTY 500 (500 Companies) High Volatility High Returns when Compared to NIFTY 50.

How NIFTY Index Follows GDP?

GDP Grows when Buying Power of People Increase when More sales generated more business for companies.

Most of the Companies Listed on the share market, it automatically Reflects the Economy. (But there is a slight difference in economy & Share Index)

It’s the best Option New Investors to Avoid Loss, Charges, and Steady growth along with the economy.

Data, analysis, reasoning decides the fact.

why i closed fd (6.25%) invested in index funds /etf?

low rate (july 2015 to 2020) 20k to 27k

as money has to be double 24% in 3 years or 4 years in elss

72/8=9

72/24=3

72/15=4.8

72/6=12

inflation rate 8-10% (4 currently* fd rate 1-2%more than inflation i guess. saving account rate 4%

index funds cargr

large cap

mid cap

index funds vs regular mf funds

low annual charges 0.1-o.5% vs 1-2%

buying in all companies some proportion ex: 50 companies risk minimized (don;t be a trader be a investor)

nifty 50 vs nifty 500 vs nifty next 50 vs NIFTY 100 (NIFTY 50 and NIFTY Next 50)

NIFTY 100 represents top 100 companies based on full market capitalisation from NIFTY 500. This index intends to measure the performance of large market capitalisation companies.

why economy grows the buying power /comports increases generation to generation.

stock market follows economy

NEWS: 6/5/2019:

Trump raised import taxes from 25% on $200 billion in Chinese products. This caused Nifty fall 127, Sensex 454points This is low when compared to global markets.