What are Mutual Funds?

Funds are fooled by a group of people to collect big money to invest in stocks, bonds, etc. returns and risks are mutually divided.

How Mutual funds work:

A company called Asset Management Company offers retails investors to buy a mutual fund plan. that offers various returns & expense based on portfolio investors buy that plan.

Asset Management Company also called as AMC Consist of Fund manager for specific Plan, he is an influencer in our return or loss.

Mutual fund charges:

Expense ratio: 2.25 -2.50% of your invested value computed daily, while your invest on return will be 10-15% after excluding all charges.

Other charges including Exit load, Account management charge, Advertising charges, etc. check Mutual fund charges vs stock trading charges

What is Nav?

NAV Means Net Asset Value of your share after deducting all charges & expenses calculated daily. you can check it on AMC Company official website.

What are AMC Companies:

banks, SBI, ICICI, Reliance, HDFC, etc

People Invest in mutual funds for

- Save tax

- Growth

- Aggressive growth

Mutual fund Industry in India

- Assets under management (AUMs) of mutual funds Companies >> 43

- mutual fund schemes are over 2599+ in India.

- MF Accounts / Investors 82.5 million

- MF Industry has grown from ₹ 4.17 trillion as on 31st March 2009 to ₹23.80 trillion as on 31st March 2019, more than 5 ½ fold increase in a span of 10 years!!

CONCEPT AND ROLE OF A MUTUAL FUND

· The ownership is in the hands of the investors (Unitholders) who have pooled in their funds, so ownership is ‘Joint and

Mutual’.

· In India, Mutual Funds are constituted as a TRUST.

· Mutual Funds are not allowed to invest in ‘Art’ and ‘commodities except gold’ in India.

· Mutual fund is a vehicle to mobilize money from investors, to invest in different markets and securities, in line with the

investment objectives

· Primary role of a mutual fund is to assist investors in earning an income or building their wealth, by participating in the

opportunities available in various securities and markets.

· The money that is raised from investors, ultimately benefits governments, companies and other entities, directly or

indirectly, to raise money for investing in various projects or paying for various expenses.

· Every Mutual Fund scheme has a pre-announced or pre-defined investment objective.

· The investment that an investor makes in a scheme is translated into a certain number of ‘Units’ in the scheme. Thus,

an investor in a scheme is issued units of the scheme.

· The number of units issued by a scheme multiplied by its face value (Rs. 10) is the capital of the scheme (Unit Capital).

· The unit holder earns through “interest income” or “dividend income” or through capital gains.

·

Advantages of Mutual Funds for Investors

– Professional Management

– Affordable Portfolio Diversification

– Economies of Scale

– Liquidity

– Tax Deferral

– Tax benefits

– Convenient Options

– Investment Comfort

– Regulatory Comfort

– Systematic Approach to Investments

· Limitations of a Mutual Fund

– Lack of portfolio customization

– Choice overload

– No control over costs

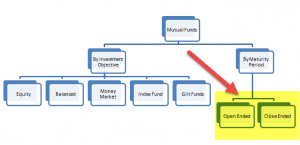

Types of Mutual funds

- Money market / liquid funds: debt bonds with a short term up to 39 days

- Fixed income funds. Debt funds : govt / corporate bonds

- Equity funds. (invested Stocks

- Balanced funds: (Asset allocation Debt & Equity)

- Index funds: Invests in Sensex top 50 Companies (passively managed funds)

- Specialty funds: real estate, commodities

- Fund-of-funds: Invests in other mutual funds

- Gilt funds: type of debt funds invested in only government securities (safety is a key factor)

Direct Vs Regular Mutual funds

Direct Means: Directly buying from AMC. (without commission for agent /distributor)

Regular: Through MF Distributor Attracts High Commission (your expense ratio high on Regular funds because you are paying commission to an agent)

These are based on Investment Type & Nature of Investments

Investment Type:

SIP: Systematic investment Plans (buying stocks weekly/Monthly/Quarterly/ basis compound interest advantage)

Lumpsum: Invest at one time: (if the stock price fall down than the actual price it would be better but if the stock falling continuously you get loss)

SIP vs Lumpsum

SIP Helps to sustain in market conditions while LumpSum buy bulk at low or high (makes a big loss or return it’s not a good idea buy bulk in a volatile market)

Equity Mutual funds: Invested in company shares (High-risk high Returns)

Debt Funds: invests in fixed income annual at maybe 7-8% treasury bills & government Bonds.

Hybrid Funds: Mix of Equity and debt funds

3 types

- balanced funds 65% in equity 45% in debt

- Equity-oriented more than 65% in equity

- Debt-oriented 60% in debt schemes

Above are the basic types but due to market competition many mutual funds named on type of category, nature etc.

EX:

- Large-cap: investing large capital companies (low risk)

- Mid-cap

- the small cap (high risk and high return)

Short term

Long term

tax Saving ELSS (up to 150000 deductions under 80C)

Some name comes with Company type of mutual funds

open-ended vs closed-ended mutual fund

closed-end fund: JUst like Stocks Through IPO traded on the stock exchange,

- Term 3, 5, 7 years buying only at NFO (New Fund Offer) by mutual fund companies

- Sell only after the term.

- Helps to fund manager to trade effectively.

- Lumsump only no redemption

- expense ration 2.5% high*

Open-Ended: Mutual fund companies sell this to investors based on NAV. continuous exist no end.

- Buy & Sell anytime

- SIP Allows

- The fund manager may confuse uncertain withdraw/redemption/selling of UNIT/Assets/Investments or stocks.

ETFs(exchange-traded funds) and CEFs( closed-end funds)

CEFS are actively managed so expense ration high return & risk varies.

while ETSfs passively managed through Index listed companies. only requires when a company removes from the large-cap list ex: nifty 50 direct.

Tax Saving Mutual Funds ELLS

- Reliance Tax Saver Fund.

- DSP BlackRock Tax Saver Fund.

- SBI Magnum Tax gain Scheme

- ICICI Prudential Long Term Equity Fund (Tax Saving)

ex:

- Tata Retirement Savings Fund – Moderate Plan

- HDFC Balanced Fund

- L&T India Prudence Fund

- Principal Balanced Fund

- ICICI Prudential Balanced Fund

· Open-ended funds are open for investors to enter or exit at any time, even after the NFO.

· When existing investors acquire additional units or new investors acquire units from the open-ended scheme, it is

called a sale transaction.

· When investors choose to return any of their units to the scheme and get back their equivalent value (in terms of units),

it is called a re-purchase transaction.

· Close-ended funds have a fixed maturity. On maturity, the money is credited back to investors’ account.

· Investors can buy units of a close-ended scheme from the AMC, only during it’s NFO.

· After the NFO, investors who want to buy and sell units of closed-ended scheme can do it through stock exchanges.

· In the closed-ended scheme the unit capital, as well as the number of units of the scheme, remain fixed.

· Interval funds combine features of both open-ended and close-ended schemes.

· The periods when an interval scheme becomes open-ended, are called ‘transaction periods’.

· The period between the close of a transaction period, and the opening of the next transaction period is called ‘interval

period’

· Minimum duration of transaction period is 2 days, and minimum duration of interval period is 15 days.

· Actively managed funds are the funds where the fund manager has the flexibility to choose the investment portfolio,

within the broad parameters of the investment objective of the scheme.

· Passive funds invest on the basis of a specified index or portfolio, whose performance it seeks to track.

· Exchange Traded Funds (ETFs) are also passive funds whose portfolio replicates an index or benchmark such as an

equity market index or a commodity index.

· The units of the ETFs are traded at real time prices that are linked to the changes in the underlying index.

· The investment objective of equity funds is to seek capital appreciation through investment in equity and equity-related

instruments.

· Schemes with an investment objective that limits the investments in debt securities such as Treasury Bills, Government

Securities, Bonds and Debentures are called debt funds

· Hybrid funds have an investment charter that provides for investment in both debt and equity. Some of them invest in

gold along with either debt or equity or both.

· Gilt funds invest in only treasury bills and government securities, which do not have a credit risk

· Corporate bond funds invest in debt securities issued by companies, including PSUs.

· Liquid schemes or money market schemes are a variant of debt schemes that invest only in short term debt securities

with a maturity of upto 91 days.

· In a liquid scheme, the securities in the portfolio having a maturity of more than 60 days need to be valued at market

prices.

· Ultra short-term plans are also known as treasury management funds, or cash management funds.

· Short Term Plans combine short term debt securities with a small allocation to longer-term debt securities.

· Long-term debt schemes such as Gilt funds and Income funds invest in longer-term securities issued by the

government and other corporate issuers.

· Diversified debt funds or Income funds invest in a mix of government and non-government debt securities such as

corporate bonds, debentures and commercial papers.

· Junk bond schemes or high yield bond schemes invest in securities that have a lower credit rating indicating poor credit

quality.

· Dynamic debt funds are flexible in terms of the type of debt securities held and their tenors.

· Fixed maturity plans are a kind of debt fund, where the duration of the investment portfolio is closely aligned to the

maturity of the scheme.

· Floating rate funds invest largely in floating rate debt securities i.e. debt securities where the interest rate payable by

the issuer changes in line with the market.

· Diversified equity fund is a category of funds that invest in a diverse mix of securities that invests across sectors and

market capitalizations.

· Market Segment based fund invests in companies of particular market size. Equity stocks may be segmented based

on market capitalization as large-cap, mid-cap, and small-cap stocks.

· Sector funds invest in only a specific sector. Eg. Technology Funds

· Thematic funds invest in line with an investment theme. Eg. Infrastructure Funds

· Value funds invest in shares of fundamentally strong companies that are currently under-valued in the market with the

expectation of benefiting from an increase in price as the market recognizes the true value.

· Growth Fund portfolios feature companies whose earnings are expected to grow at a rate higher than the average rate.

· Focused funds hold portfolios concentrated in a limited number of stocks.

· Equity Linked Savings Schemes (ELSS) are diversified equity funds that offer tax benefits to investors under section 80

C of the Income Tax Act up to an investment limit of Rs. 150,000 a year.

· ELSS funds are required to hold at least 80 percent of its portfolio in equity instruments.

· The investment is subject to a lock-in period of 3 years, during which it cannot be redeemed, transferred or pledged.

· Rajiv Gandhi Equity Savings Schemes (RGESS) offer tax benefits to first-time investors

· In RGESS , investments are subject to a fixed lock-in period of 1 year, and flexible lock-in period of 2 years.

· Hybrid funds invest in a combination of asset classes such as equity, debt and gold.

· Debt-oriented Hybrid funds invest primarily in debt with a small allocation to equity.

· Monthly Income Plan is a type of debt-oriented hybrid fund that seeks to declare a dividend every month.

· Multiple Yield Funds generate returns over the medium term with exposure to multiple asset classes, such as equity

and debt.

· Equity-oriented Hybrid funds invest primarily in equity, with a portion of the portfolio invested in debt to bring stability to

the returns.

· Capital Protected Schemes are close-ended schemes, which are structured to ensure that investors get their principal

back, irrespective of what happens in the market.

· Arbitrage funds take opposite positions in different markets/securities, such that the risk is neutralized, but a return is

earned.

· Gold funds invest in gold and gold-related securities.

· Gold Exchange Traded fund, which is like an index fund that invests in gold, gold receipts or gold deposit schemes of

banks.

· Gold funds invest in the units of Gold Exchange Traded Funds.

· Gold Sector fund will invest in shares of companies engaged in gold mining and processing.

· International funds invest in markets outside India, by holding certain foreign securities in their portfolio.

– Domestic AMC – Feeder Fund

– Foreign AMC – Host Fund

· A Fund of Funds (FoF) is a mutual fund that invests in other mutual funds.

· An FoF imposes an additional cost on the investor, as the expenses of the underlying funds are built into their NAV.

· Exchange Traded funds (ETFs) are open-ended funds, whose units are traded in a stock exchange.