RBL Credit card different from one credit card to another credit card, Minimum reward points 0.25% cashback and rbl banks earns 2% on each transaction. In today’s fast-paced world, credit cards have become indispensable financial tools, offering convenience and a plethora of benefits to consumers. Among these perks, reward points stand out as a particularly enticing feature, allowing cardholders to earn points with every transaction and redeem them for a variety of rewards. One such offering is the RBL Credit Card reward points program, which provides cardholders with a host of opportunities to maximize their spending and enjoy additional perks.

Understanding RBL Credit Card Reward Points

RBL Bank, one of India’s leading private sector banks, offers a range of credit cards tailored to suit diverse lifestyles and preferences. Each of these cards comes with its own set of benefits, including reward points programs designed to add value to every transaction.

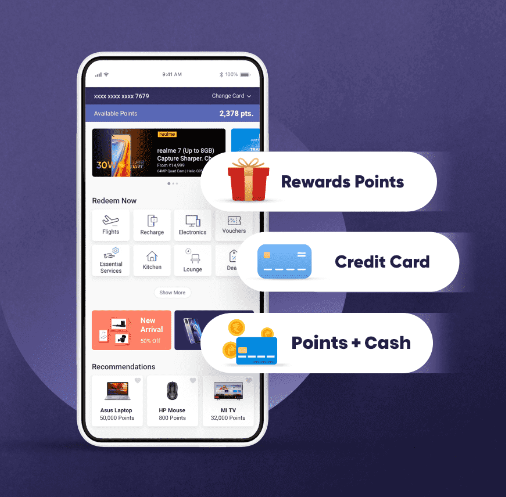

The RBL Credit Card reward points system operates on a simple premise: the more you spend using your card, the more points you accumulate. These points can then be redeemed for a variety of rewards, ranging from vouchers and merchandise to travel bookings and statement credit.

- 1 point = 0.25₹ or 0.20₹

- 2 reward points on 100 spent

- 0.50 rupees for 100 spent 0.5%.

20x reward points dining & international spend max 2000 points for month.

2000 reward points= 500₹

1lakh spend 0.25%

100000= 2000 reward points = 500₹ 0r 400₹ as cashback in the form of reward points.

Milestone reward points:

milestone reward points get you additional extra points once your spend the targeted amount in financial year.

300000 spends 6000+20000 = 26000

26k Reward points= 6500₹

credit card annual fee: 4000+GST = 4800₹

500000 spends

10000 + 20

30k reward points = 7500

| Credit Card | Annual Fee | Key Reward Benefits |

| RBL Bank ShopRite Credit Card | Rs. 500 | 20 reward points per Rs. 100 spent on groceries |

| RBL Bank Platinum Delight Credit Card | Rs. 1,000 | 1,000 reward points per month on making min. 5 transactions in a month |

| RBL Bank Platinum Maxima Credit Card | Rs. 2,500 | 10 reward points per Rs. 100 dining, entertainment, fuel, utility bills & international spends; 10,000 reward points as joining & milestone benefits |

| RBL Bank World Safari Credit Card | Rs. 3,000 | Up to 5 travel points per Rs. 100 spent; Up to 25,000 travel points as milestone benefits |

| RBL Bank Icon Card | Rs. 5,000 | 20 reward points per Rs. 100 international & dining spends on weekends; 20,000 reward points on joining |

Rbl reward redemption fee

there is also fee Rs.99+gt on every redeem once in in a day.

99+GST

personal experience:

9000+

1 year recharge done on idea 1799,

3 months recharge on 455 on Airtel

98 remaining

Closing rbl credit card because of 3999+GST

Unlocking the Benefits of RBL Credit Card Reward Points

- Mobile recharge

- Amazon Gift card as amazon balance

- Shopping and many vouchers

recharge on jio rbl reward points not working properly as of Feb 2022, earlier jio not in the list.

Amazon prime gift card only worth of 2000

8000+ reward points necessary to redeem.

as sbi reward points 2000 points for 500₹ Amazon voucher.

How to redeem reward points at rblrewardpoints.com

Step 1: Visit the RBL Rewards portal.

Step 2: If you are a new user, click on “Register Here”

Step 3: Enter your credit card number, date of birth and the OTP received on your mobile number to register.

Step 4: Now, login to the portal using your login ID and password.

Step 5: Select the category and the product/ option against which you want to redeem your reward points.

Step 6: Click on ‘Redeem Points’ and select the number of points you want to redeem.

Step 7: Enter the OTP received on your registered mobile number for verification.

After a successful verification, the transaction will be completed and you will receive a confirmation message on your registered mobile number.

### How to Earn RBL Credit Card Reward Points

Earning RBL Credit Card reward points is easy and straightforward. Cardholders earn points for every eligible transaction made using their credit card. The number of points earned per transaction may vary depending on the type of card and the specific offer in place at the time of purchase.

Typically, RBL Credit Card reward points are accrued based on a predetermined points-to-transaction ratio. For example, cardholders may earn one point for every INR 100 spent on eligible purchases. Some cards may offer accelerated points earning on specific categories such as dining, groceries, or fuel, allowing cardholders to accumulate points more quickly.

### Maximizing Your RBL Credit Card Reward Points

To make the most of your RBL Credit Card reward points, it’s essential to understand the various redemption options available. RBL Bank offers a diverse range of redemption choices, allowing cardholders to tailor their rewards to their preferences and lifestyle.

1. **Merchandise**: Redeem your points for a wide selection of merchandise, including electronics, home appliances, fashion accessories, and more.

2. **Gift Vouchers**: Exchange your points for gift vouchers from leading brands across various categories such as dining, shopping, entertainment, and travel.

3. **Travel Bookings**: Use your points to book flights, hotels, and holiday packages through RBL Bank’s travel portal, offering flexibility and convenience for your travel needs.

4. **Statement Credit**: Offset your credit card bill by redeeming points for statement credit, reducing your outstanding balance effectively.

### Tips for Optimal Rewards Redemption

To ensure you get the most value out of your RBL Credit Card reward points, consider the following tips:

– **Stay Updated**: Keep an eye out for special promotions and offers that can help you earn bonus points or enjoy discounted redemptions.

– **Plan Your Redemptions**: Strategically plan your redemptions to maximize the value of your points. For instance, consider saving up points for larger redemptions that offer better value per point.

– **Check Validity**: Be mindful of the expiry date of your reward points to avoid losing them. Utilize a proactive approach to redeem points before they expire.

### In Conclusion

RBL Credit Card reward points offer cardholders a fantastic opportunity to earn rewards on their everyday spending. With a range of redemption options and the potential for accelerated earnings, these points add significant value to the cardholder experience. By understanding how to earn and redeem points effectively, cardholders can unlock a world of benefits and make the most of their RBL Credit Card. So, start swiping and start earning – your rewards await!