rent vs buy emi vs rent home loan vs sip in telugu

rent or buy calculator

full payment or loan

home loans at low rate (just below 2% equals to inflation). tax benefits.

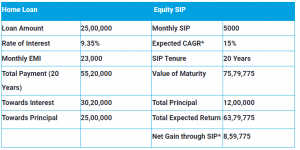

SIP vs Home loan

buying for rental income

1-2% monthly rent or 10% yearly 10 years property free.

1 cr 50K 6 lakhs 7% better yield.depends on area.(appreciation,inflation)

70 lakhs

rent 7k

1% 1.2% (70 lakhs 7-15% 10% 7oK)

appreciation is speculation 10-20% appreciation, property depreciation,

property tax, maintenance 1% home loan 3%.

20 years buying cost 83.lacks renting 40 lakhs

home loan vs sip

interest rate 10% 10% to 15%

14 lakhs as lump sum for 20 years.

46 lakhs as sip for 20 years

Mutual fund SWP vs home rent

Thumb Rule: unsecured job, no financial discipline or sudden money then go invest in house.

How do people make money by renting?

- foreclosed, house under market value with cash.

- Cash Flow (positive cashflow rent vs buy)

- Amortization (EMI goes down rent increases)

- Appreciation of property

- Tax Benefits

Buying Home/Property for Rental Purposes

for renting

buying home or rent

Property price

Appreciation

Rent

Monthly income

loan

Down payment

10 lac

Loan Amount 40 lac

Loan Tenure

Interest rate

tax

The deductible amount in 80C

Tax slab (10, 20,-30%)

Annual savings

Rental Property vs. Mutual Funds (EMI VS SIP)

good rental yield for rental property is generally 8% or more. Anything below that, might not be sufficient to cover running costs and mortgage payments.

Mutual funds have historically returned 7- 9 %.

80% (40 lakhs) on the loan (EMI or Rent)

20% (10 lakhs) as a downpayment or (lumpsum investment in MF /ELSS or index funds)

50 lakhs home, 6K rent

20 Years Term

Principal: Rs. 40,00,000 (46.1%)

Interest Payable: Rs. 46,68,263 (53.9%)

Total Amount Payable: Rs. 86,68,263.8

Interest rate: 9.05pa (only for govt)

EMI: 36117.17 after 20 years 86,68,263.8

Rent: 6,000 (5% increase in evey years) after 20 years = 24,44,746.70

10 Lakhs at lumsump after 20 years at 10 CAGR* = 67,27,499.95

4-6% registration charges

EMI – Rent = 8668263.8-2444746.70 = 62,23,517.1

Total savings for rent (6223517.1+6727499.95= 1,29,51,017.1

Property appreciation at 5% (10%- 5%inflation rate) CAGR for 50 lakhs for 20, years = 1,3266,488.53

- Maintanence + property taxes = 1% of

- Proprtery taxes (15-30% of the annual rental value)

- Maintanence (0.25 to 0.25) of property value.

- loan EMI interest 10%

Property depreciation + Land appreciation

Investing in land vs other (Mutual funds, FD, Stocks etc) Best place to invest in hyderabad

Value Investing In Real estate

understanding the difference between price and intrinsic value

PEGR>> Expected Growth rate based on fast & Future years.

Expecting people where the go // because of companies or jobs, facilities roads, train expansion, focus on developing area areas