Buy when growing sell when falling with stop loss just like trading. (rule followed by rakesh jhun jhun wala).

sit on cash when no opportunities instead of loosing opportunity cost with sidelined stocks.

chase trends

ride winners ditch losers

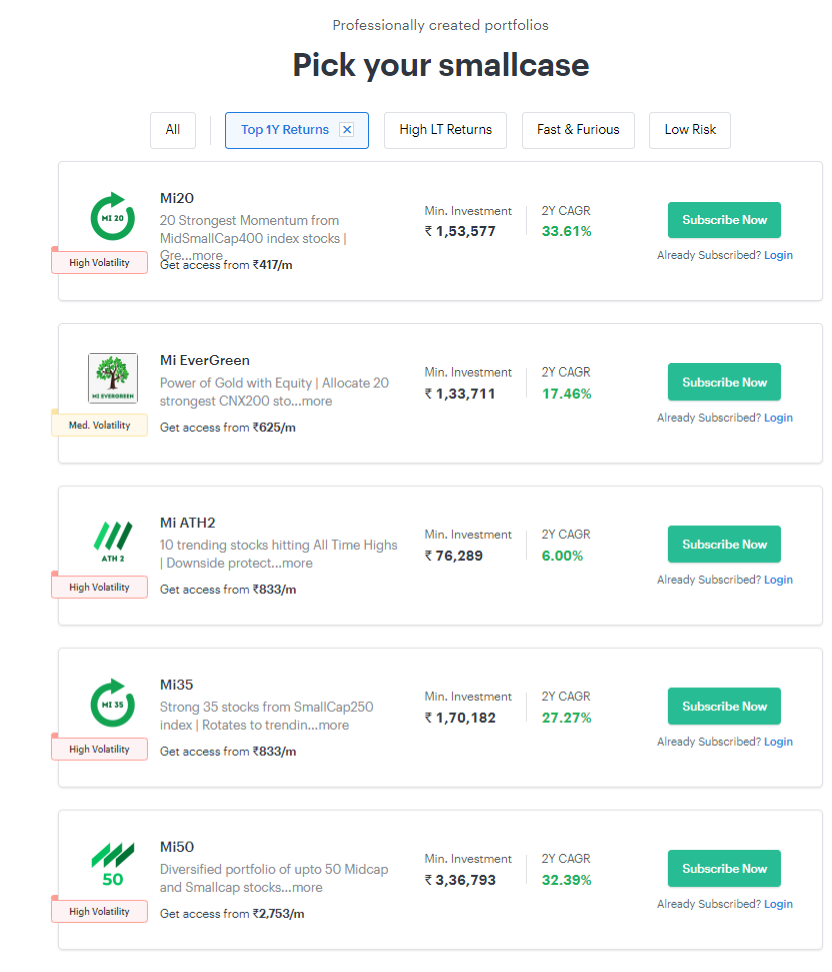

Relative momentum strategy

- picking top 20 stocks which has good return (rate of Price change) on past 12 months.

- again next month track top 20 stocks high return in past 12 months.

- total 40 stocks now,

- ditch stocks those are not in top 40 add the 21th one to top 20.

- repeat every month

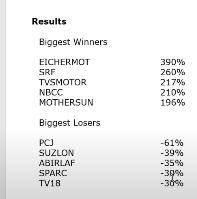

results 5 years study 2013 to 2018

cagr 31.18%

capital gain 3.9x

137 trades average hold 5 months

max drawdown (from top) 22.5%

wins 62% trades

avg win stocks 42% avg loss 12%

absolute momentum strategy

buy when stock price exceeds 200 DMA

Sell when stock goes below 200 DMA

buy at 200 DMA +5%

Sell at – 200 DMA – 5%

whiplash filter 5%

liquidity filter 1 cr turnover annually

results

200 dma 2003 to 2018 (15 years)

capital: 40x

cagr: 25.5x

max draw down 57%

461 trades average hold 11 months

wins 31% trades

return

average winner stock 117% gain trades loose -13.5% loss.

20 stocks in the list if they were in top 20