Features

- Additional tax Benefit up to 50,000 Under 80CCD (Under section 80C 1.5 lakh).

- Flexible Investment Minimum 1000 INR(yearly Contribution) to no limit but (up to 2 lakhs tax exempted ).

- Pay Monthly or yearly On Mobile App You can Increase / Decrease contribution Limits.

- Returns 8-10%

- Lock-in Period Till The Retirement or 60 Years. extended up to 70 Years.

- Withdrawal 60% at Maturity remaining 40% Given on Monthly pensions basis.

How NPS (National Pension System) Scheme Works?

- After Opening Account online or POS. Your Amount invested in the Stock market (equity & debt). this yields high returns.

- Your Amount Managed by Fund managers. they buy /sell stocks to book returns. so your returns will be high because you are investing longterm. After 60 years you get 60% amount by Lumpsum. 40% in the form annuities/pension.

Eligibility:

- Any Person in India & NRI* (Self-employed, Govt employees, Private Employees)

- 18-60 Years age Limit

Tax Benefits

- This Scheme Comes Under EEE status No tax at all But Pensions are taxed. (You should add to income and file return according to slab)

- claim Deductions up to 2 lakhs

- 80CCD(1B) 50,000 and 80C up to 1.5 Lakh

- 80CCD(1) Contributions 10% of basic Salary for the employee. 20% for Self Employed Gross Income with the above limits allowed tax exemption.

- – 80CCD(2) : contribution by employer by upto. 10% of Basic + DA.

- New rule epf+nps+employer insurance limit set to..

Withdrawal Rules

LOCK in period at 60 years Age: you can extend up to 10 Years.

At 60 years of You can withdrawal 60% of amount without any tax. 40% Given Insurance company to provide Pension benefits. (You can choose later).

Premature withdrawal after 3 years allowed, 25% Of Your Contribution 3 Times in your entire life and with 5 Years Gap between withdrawals.

Early withdrawal allowed for Buying Home. Child education marriage critical illness for family self.

Asset Allocation:

- Active Choice: subscriber can choose equity up to 75% or Debt scheme (Corporate or Government Bonds, Just like FD)

- Auto Choice: based on Your Age & Income decided by the Fund manager.

- Subscriber allowed to Change Asset Allocation twice in a Year. Also, change the Fund manager once in a Year.

NPS TIER 1 Account Vs TIER 2 Account

TIER 2 Account Just Like Mutual Fund scheme, No tax Benefit at all.

Its’ a voluntary Tier 1 account Required for This. You can invest and withdraw any Time No limits.

Why we need a Tier 2 Account? To manage all funds (Portfolio at one place).

Why NPS subscribers activate TIER 2 account Becuase they are Already dealing Market Risk.

Getting Tier 2 Account Very easy, visit https://enps.nsdl.com >> NPS>> Registration>>Activate Tier 2(Enter your Pran & pan and follow further steps)

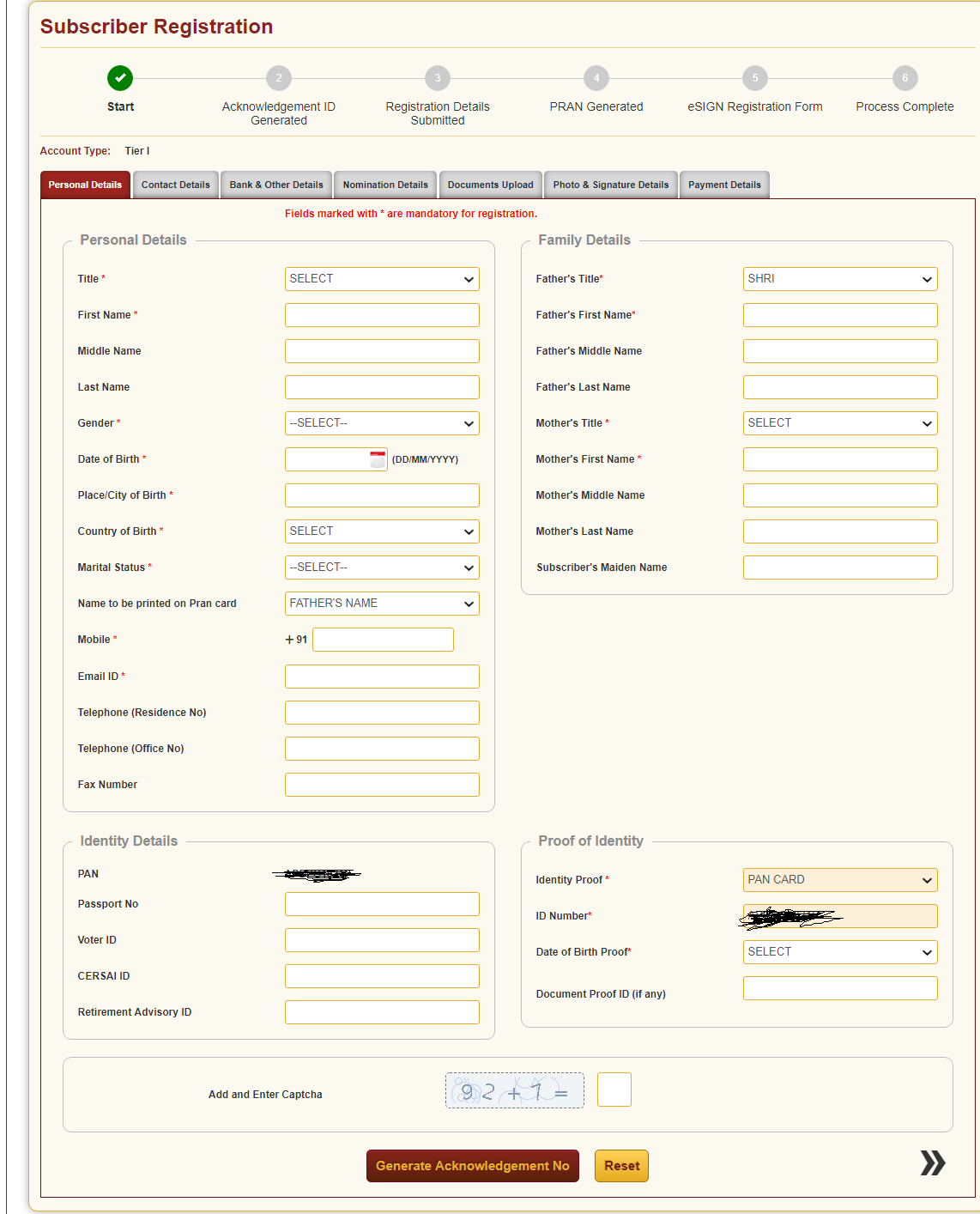

How to Open NPS Account?

Offline: Visit any PoP Point (banks, Govt’s Nodal office), almost 55 Banks Provide NPS Account offline.

You can find it by visiting the NPS website and selecting your area & Pincode.

Submit KYC and pay a minimu subscription

Monthly 250 INR or 500 INR or 1000INR Per year. After registration completed. they will send a welcome Kit which Contains PRAN – Permanent Retirement Account Number. (a 12 digit Number to Operate your account).

Online process:

- Visit https://enps.nsdl.com/,

- Click National Pension System instead of Atal pension Yojana.

- Then click On Register (NOTE: Your pan Mobile Number should be linked with Aadhaar card)

- It asks you to enter PAN Number & choose Bank (Stock Broker)

- Then Below form will appear complete details your PRAN generates and follow the furhter process. (watch a video on youtube)

How To make NPS contribution Online?

- Visit https://enps.nsdl.com/, and click on NPS and Then Click on Contribution.

- Then Enter Your PRAN Number and Date Of Birth. It will send you OTP your Mobile or email.

- Login & Pay the contribution monthly Once or Yearly Once.

- You can also Pay the amount by NPS Trust app available on Google Pay.

NPS Trust Portal Login Benefits/features

- Update FATCA details

- Update Email ID/Mobile number

- Reprint PRAN Card

- Change in Scheme Preference

- Tier II Withdrawal

- View Account Details/Transaction Statement

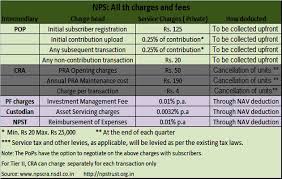

NPS VS PPF VS ELSS VS FD

| Scheme | Interest | Lock-in period | Risk | Tax |

| NPS | 8% to 10% | Till retirement | High (Long term *) | EEE |

| ELSS | 12% to 15%) | 3 | Very high (market risk*) | EEE |

| PPF | 8.1% | 15 | No risk | EEE |

| FD | 7% to 9% | 5 | No Risk | ETE |

Note: we compared all saving schemes here.

In the case of FD: ETE: Earrings / Intrest are taxed. you should add this to Interest income from other sources. computer your tax accordingly in ITR.

how to open nps account by employer

Companies has to registered through pop,

Once corporate get the company registration number CHO/BHO.

then corporate open nps account behalf of employees. And start deducting the salary.

just like epf registration by employer, nps also has same process.

if your employer pays to nps or deduct behalf of nps. Then your net salary also decreases

Employer has clear idea of CTC(cost to the company)

Nps voluntary basis for private.

Is nps compulsary for govt employees?

NPS is mandatory for all govt employees who joined after 1/1/2004. 10 % of basic pay +da is compulsory contribution -Govt contributes equal amount.

corporate nps vs individual nps

Anyone can open nps , regardless of employment, whether in private, public or self employed.

2 nps accounts employer & individual by same person.

Documents required for nps at employer or individual

Almost all financial services companies likehlike banksebanks themselves as POPs.

Kyc documents

Id & adress proof(aadhar,pan, passport)

References

- https://cra.karvy.com/POPONLINE/POPAuthenticate#

- https://cra-nsdl.com/CRA/

- https://www.npscra.nsdl.co.in/

- https://www.youtube.com/channel/UCHu3qDE4hRaoIYc2OpZUbYA

- http://www.npstrust.org.in/content/pension-calculator

- http://www.npstrust.org.in/return-of-nps-scheme