NISM-Series-XV exam pattern

- 0.25 negative marks for wrong answer.

- 92 questions Multiple choice each 1 marks

- case based questions 4*2 8 Marks

- Exam duration 1 hours pass mark 60%

- exam fee 1500 rupees

What is the assessment structure for NISM Research Analyst Certification Examination?

| DURATION | 120 MINUTES |

| NO. OF QUESTIONS | 100 |

| MAXIMUM MARKS | 100 |

| PASS MARKS | 60 |

| NEGATIVE MARKS | 25% FOR EACH WRONG ANSWER |

| CERTIFICATE VALIDITY | 3 YEARS FROM DATE OF EXAM |

| EXAM FEES | Rs. 1600/- |

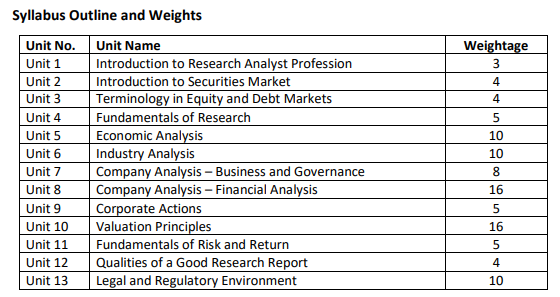

What is the syllabus outline for NISM Series XV – Research Analyst Certification Examination?

| Chapter No. | Chapter Name | Weightages % |

| 1 | Introduction to Research Analyst Profession | 3% |

| 2 | Introduction to Securities Market | 6% |

| 3 | Terminology in Equity and Debt Markets | 6% |

| 4 | Fundamentals of Research | 5% |

| 5 | Economic Analysis | 7% |

| 6 | Industry Analysis | 10% |

| 7 | VII. COMPANY ANALYSIS – BUSINESS AND GOVERNANCE | 7% |

| 8 | Company Analysis – Quantitative Dimensions finacials | 15% |

| 9 | Corporate Actions | 6% |

| 10 | Valuation Principles | 15% |

| 11 | Fundamentals of Risk and Return | 5% |

| 12 | Qualities of a good Research Report | 5% |

| 13 | Legal and Regulatory Environment | 10% |

| Total | 100% |

I. INTRODUCTION TO RESEARCH ANALYST PROFESSION

A. Primary Role of a Research Analyst

B. Primary Responsibilities of a Research Analyst

C. Basic Principles of Interaction with Companies/Clients

D. Important Qualities of a Research Analyst

II. INTRODUCTION TO SECURITIES MARKET

A. Introduction to Securities and Securities Market

B. Product Definitions / Terminology

C. Structure of Securities Market

D. Various Market Participants and Their Activities

E. Kinds of Transactions

F. Dematerialization and Rematerialization of securities

III. TERMINOLOGY IN EQUITY AND DEBT MARKETS

A. Terminology in Equity Market

B. Terminology in Debt Market

C. Types of Bonds

IV. FUNDAMENTALS OF RESEARCH

A. What is Investing?

B. The role of research in investment activity

C. Technical Analysis

D. Fundamental Analysis

E. Quantitative Research

F. Behavioral Approach to Equity Investing

V. ECONOMIC ANALYSIS

A. Basic Principles of Microeconomics

B. Basic Principles of Macroeconomics

C. Introduction to Various Macroeconomic Variables

D. Role of economic analysis in fundamental analysis

E. Secular, cyclical and seasonal trends

F. Sources of Information for Economic Analysis

VI. INDUSTRY ANALYSIS

A. Role of industry analysis in fundamental analysis

B. Defining the industry

C. Understanding industry cyclicality

D. Market sizing and trend analysis

E. Secular trends, value migration and business life cycle

F. Understanding the industry landscape

G. Key Industry Drivers and Industry KPIs

H. Regulatory environment/framework

I. Taxation

J. Sources of information for industry analysis

VII. COMPANY ANALYSIS – BUSINESS AND GOVERNANCE

A. Role of company analysis in fundamental research

B. Understand Business and Business Models

C. Pricing Power and Sustainability of This Power

D. Competitive Advantages/Points of differentiation over the Competitors

E. Strengths, Weaknesses, Opportunities and Threats (SWOT) Analysis

F. Quality of Management and Governance Structure

G. Risks in the Business

H. History of credit rating

I. ESG framework for company analysis

J. Sources of Information for Analysis

VIII. COMPANY ANALYSIS – FINANCIAL ANALYSIS

A. Introduction to financial statement

B. Stand-alone financial statement and consolidated financial statement

C. Balance Sheet

D. Basics of Profit and Loss Account (P/L)

E. Statement of changes in shareholder’s equity

F. Basics of Cash Flows

G. Notes to accounts

H. Important Points to Keep In Mind While Looking At Financials

I. Reading audit report to understand the quality of accounting

J. Financial statement analysis using ratios

K. Commonly used ratios

L. Dupont analysis

M. Forecasting using ratio analysis

N. Peer Comparison

O. Other aspects to study from financial reports

IX. CORPORATE ACTIONS

A. Philosophy of Corporate Actions

B. Dividend

C. Rights Issue

D. Bonus Issue

E. Stock Split

F. Share Consolidation

G. Merger and Acquisition

H. Demerger / Spin-off

I. Scheme of arrangement

J. Loan Restructuring

K. Buyback of Shares

L. Delisting and relisting of Shares

M. Share Swap

X. VALUATION PRINCIPLES

A. Difference Between Price and Value

B. Why Valuations are required

C. Sources of Value in a Business – Earnings and Assets

D. Approaches to valuation

E. Discounted Cash Flows Model for Business Valuation

F. Relative valuation

G. Earnings Based Valuation Matrices

H. Assets based Valuation Matrices

I. Relative Valuations – Trading and Transaction Multiples

J. Sum-Of-The-Parts (SOTP) Valuation

K. Other Valuation Parameters in New Age Economy and Businesses

L. Capital Asset Pricing Model

M. Objectivity of Valuations

N. Some Important Considerations in the Context of Business Valuation

XI. FUNDAMENTALS OF RISK AND RETURN

A. Concept of Return of Investment and Return on Investment

B. Calculation of Simple, Annualized and Compounded Returns

C. Risks in Investments

D. Measuring risk

E. Concepts of Market Risk (Beta)

F. Sensitivity Analysis to Assumptions

G. Concept of Margin of Safety

H. Comparison of Equity Returns with Bond Returns

I. Calculating risk adjusted returns

J. Basic Behavioral Biases Influencing Investments

K. Some Pearls of Wisdom from Investment Gurus across the World

L. Measuring liquidity of equity shares

XII. QUALITIES OF A GOOD RESEARCH REPORT

A. Qualities of a Good Research Report

B. Checklist Based Approach to the Research Reports

C. A Sample Checklist for Investment Research Reports

XIII. LEGAL AND REGULATORY ENVIRONMENT

A. Regulatory infrastructure in Financial Markets

B. Important regulations in Indian Securities Market

C. Code of Conduct for Research Analysts

D. Management of Conflicts of Interest and Disclosure Requirements for Research Analysts

E. Exchange surveillance mechanisms: GSM and ASM

sebi registered research analyst eligibility

Have a postgraduate degree or professional qualification in finance, accountancy, commerce, economics, business management, capital market, financial services, or markets

or

Have a graduate degree in any discipline with five years of experience in the financial sector.

or

Pg diploma in securities market by NISM 1 year or above 15 months weekend course.

Last Date for Application 28th March, 2024. The consolidated program fee for PGP (PM/IA/RA) in the Securities Market is Rs. 2,75,000/-+ G.S.T.

and

Pass NISM-Series-XV by the National Institute of Securities Markets (NISM)

MBA in finance, diploma in finance, CA,

5 years expecirecie in Fiance Insurance agent, mutual fund distrcutor with ARN card.

The Applicant for grant of registration as a Research Analyst under SEBI

(Research Analyst) Regulations, 2014 shall make an application to SEBI in Form

A as provided in the Regulations from Page number 25 to Page No. 29 along

with all the necessary supporting documents