Why SBI Card Share Price Falling?

fundamentals good. but RBI Regulated Loan quality Asset

17 Nov 2023:

SBI Card shares fell 6.70 per cent to hit a low of Rs 720.40 on BSE. With this, the SBI Card stock has fallen 17.35 per cent in the last six months.

SBI Card shares plunge 7% as RBI move on risk weights to hit earnings, capital adequacy ratio.

capital-to-risk weighted assets ratio (CRAR), is a measure of a bank’s capital as a percentage of its risk-weighted credit exposures. It’s calculated by dividing a bank’s eligible capital by its risk-weighted assets

SBI card price falling in every October

SBI Cards and Payment Services’ share price may fall every October. In 2021, the SBI Card share price dropped by more than 5% after the company’s Q3 results fell short of expectations.

| Instrument | Qty. | Avg. cost | LTP | Cur. val | P&L | Net chg. | Day chg. |

|---|---|---|---|---|---|---|---|

| SBICARD | 68 | 844.46 |

689.35

|

46,875.80

|

-10,547.45 | -18.37% | -0.46%

as on 28/3/2024 |

| Date | Qty. | Price | Age (days) | P&L |

| 2024-03-13 | 1 | 684.05 | 15 | 5.20 |

| 2023-09-26 | 4 | 789.00 | 184 | -399.00 |

| 2023-09-26 | 8 | 789.05 | 184 | -798.40 |

| 2023-09-25 | 1 | 789.80 | 185 | -100.55 |

| 2023-09-21 | 2 | 806.70 | 189 | -234.90 |

| 2023-09-13 | 2 | 826.50 | 197 | -274.50 |

| 2023-08-28 | 2 | 816.00 | 213 | -253.50 |

| 2023-08-23 | 1 | 835.85 | 218 | -146.60 |

| 2023-07-31 | 2 | 851.50 | 241 | -324.50 |

| 2023-07-20 | 1 | 853.80 | 252 | -164.55 |

| 2023-07-17 | 2 | 848.10 | 255 | -317.70 |

| 2023-07-17 | 3 | 848.25 | 255 | -477.00 |

| 2023-07-11 | 1 | 835.25 | 261 | -146.00 |

| 2023-06-28 | 5 | 867.55 | 274 | -891.50 |

| 2023-06-28 | 5 | 872.00 | 274 | -913.75 |

| 2023-06-28 | 2 | 872.00 | 274 | -365.50 |

| 2023-06-28 | 1 | 872.00 | 274 | -182.75 |

| 2023-06-28 | 6 | 872.00 | 274 | -1,096.50 |

| 2023-06-28 | 19 | 872.00 | 274 | -3,472.25 |

| Name | CMP Rs. | P/E | Ind PE | PEG | CMP / BV | OPM % | ROCE % | ROE % | Debt / Eq | Profit Var 5Yrs % | Qtr Profit Var % | Qtr Sales Var % |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Bajaj Finance | 7239.95 | 32.52 | 19.27 | 0.91 | 7.46 | 70.37 | 11.77 | 23.48 | 4.28 | 35.77 | 22.40 | 31.28 |

| Bajaj Finserv | 1634.00 | 33.41 | 19.27 | 1.73 | 5.12 | 37.16 | 11.28 | 14.81 | 4.94 | 19.35 | 21.08 | 33.48 |

| Jio Financial | 351.30 | 8877.91 | 19.27 | 1.94 | 87.60 | 0.00 | ||||||

| Cholaman.Inv.&Fn | 1144.50 | 29.95 | 19.27 | 1.26 | 6.11 | 72.05 | 9.72 | 20.41 | 7.56 | 23.77 | 27.34 | 49.20 |

| Bajaj Holdings | 8167.80 | 15.37 | 19.27 | 1.20 | 1.84 | 73.84 | 9.71 | 11.15 | 0.00 | 12.81 | 27.91 | 9.80 |

| Shriram Finance | 2361.95 | 13.37 | 19.27 | 0.69 | 1.89 | 71.36 | 12.13 | 17.27 | 3.77 | 19.49 | 3.74 | 19.31 |

| HDFC AMC | 3772.20 | 45.23 | 19.27 | 3.04 | 13.34 | 75.43 | 32.31 | 24.47 | 0.00 | 14.89 | 32.57 | 19.97 |

| SBI Cards | 689.00 | 27.98 | 19.27 | 0.92 | 5.91 | 31.55 | 13.05 | 25.69 | 3.08 | 30.30 | 7.78 | 31.76 |

| Median: 179 Co. | 236.0 | 19.8 | 19.27 | 0.63 | 1.65 | 55.59 | 8.64 | 7.36 | 0.23 | 17.35 | 40.5 | 34.08 |

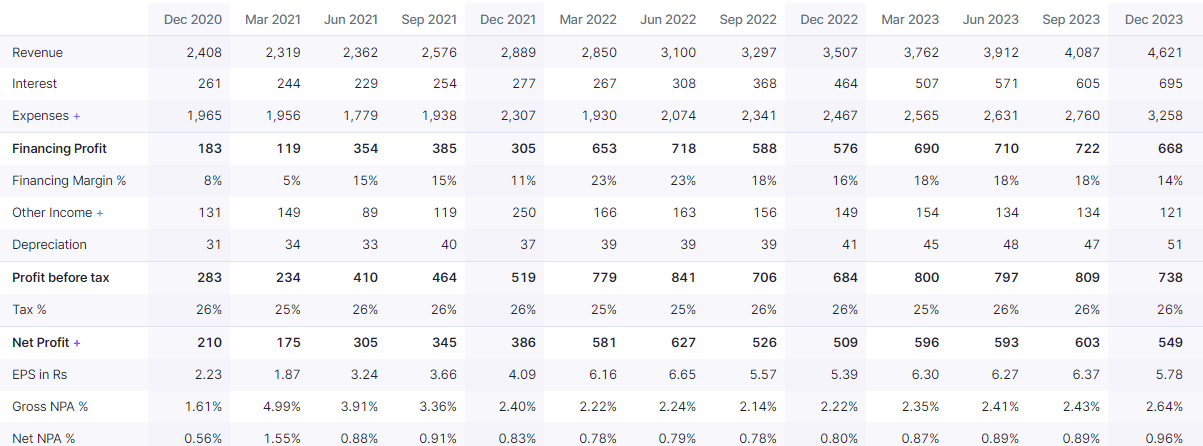

Quarterly Results

Good Yoy & QOQ

Balance Sheet

Reserves: 10,112

Equity Capital: 947

Long term Borrowings: 34,083

Total assets & Liabilities =50,388

Long term view:

India will grow credit card spend grow, competition from PAPL & UPI..

PAPL maybe competition but there is no reward points. offline purchase etc.

conclusion: not decided anything as 28/3/2024. decided to hold..

capital adequacy ratio impact

expect the impact on Tier 1 ratios to be in the range of 30-450 bps with the maximum impact on SBI Card and could warrant a capital raise. After SBI Card, Bajaj Finance will likely see a 250 bps impact on its Tier 1 ratio