# focus on profit growth

PE ratio 1

PE ratio 1 Menas company share price equals trailing 12months EPS.

Property 2 crores annual rent 1 crore = 2 PE ratio (Rent will be double* like earnings)

Hidden PE of 1

CUrrent PE / Current Earnings

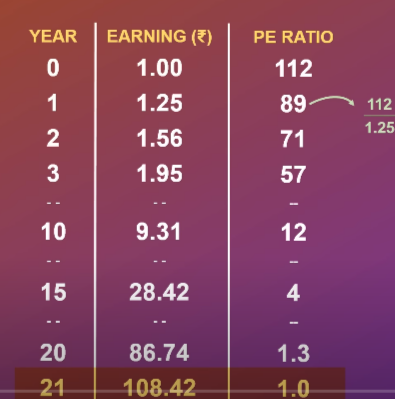

DMAT PE 100, but earnings 25% growth every year it takes 21 yers to reach pe 0f 1.

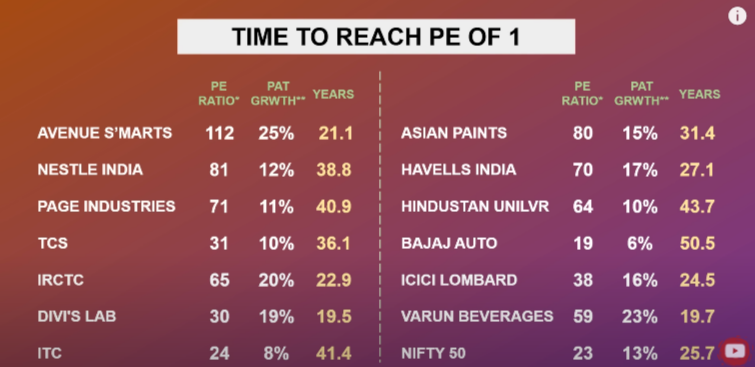

TIME TO reach PE of 1

| PE ratio | 100 | 10 |

| Earnings | 20% | 10% |

| time to reach PE of 1 | 25.3 | 24.2 years |

Leanings:

PE of 1 in 5 years only in mid & small caps.

EPS growth,

earnings can be accounted & economic earnings free cash flow per share.

Beware of cyclical business

Focus on sales & profits growth also pricing power

turnaroun comapnies.

Mohnish Pabrai: How To Earn A 25% Return Per Year (6 Investing Rules)

- shameless cloner copy the investetor portpolion quaterly or yearly

- buy stocks with moat (competitive advantage)

- Patience: you make money by waiting.

- Don;t engage in short selling

- low risk high uncertainity (high returns) (how can i lose money minimize downside)

- have a checklist 7-8 questions (normalizerd earnings or boom earnigs, debt, managment,win win ecosystem, etc)

Mohnish Pabrai’s 10 Commandments Investment Strategy

- fees fixed and then return based sahring ex: 2%+ 25% of return.

- never use team

- shalt be wrong at least 1/3 of the time 4out of 10 expected to down. dont surprise. (10 stocks 7 zero 1st 30, 2nd 20, 3rd 10 then 10 years cagr 19.6%)

- look for PE of 1 Market cap = NET profit of company.

- neve use excel

- rope to climb from deepest well

- focus on concentration

- never short stock

- never borrow or lend

- shall be a shameless cloner

THE DHANDHO INVESTOR (BY MOHNISH PABRAI) – high returns with low risk

i win or dont loose,

DHANDHO frame work

- foucs on existing business (stocks peform better than other asset classes)

- buy simple businesses in the industries slow rate of change (change is the enemey for investment)

- buy distressed business and distressed industries

- buy businesses with durable competitive advangate

- bet hevily when the odds overhlemingsly your favour

- focus on arbitrage risk free return

- buy business with huge discount with their underlying value.

- look for low risk and high uncertainity businesses

- its better to be a copy cat than inventor

2. Investing is all about odds

cash 25

Heads Probality 60%, payout 100% Tales: probality 40% payout -100%

One channce in two trades its gamble.

3 DCF Analyis discounted cash flow

1000 todays is better 1k after 10years

5% disocunt rate every year, 95%, 91% 86, 81 for 10 years 7722

10% discount rate for 10 years 6142

4. Look for row risk and high uncertinity businesses

| Probabiliyt | payout |

| 10% | 1000% |

| 40% | 30% |

| 40% | -20% |

| 10% | -100% |

according kelly BET on 75%

Agrresive, standard, conservative

Others wall street loves low risk low uncertainity,

| Probabiliyt | payout |

| 90% | 10% |

| 9% | 100% |

| 1% | -100% |

5. THE Art of selling

- Cannot sold at loss with 2-3 years of buying unless current instrinic value less than the market price. price cnange fast but busines doesn’t), time is money