I bought at 840 at one time with 30k, and then averaged 60K..

Price fallen to 740 and then 690 and then 720 and now 709..

disclaimer: valuation not alone represnts the whole pricture try business & industry analyis.

Lets understand instric value & growth rate of SBI card as on 5th August 2024.

Relative Valuation based on PE Ratio ttm vs forward others

The range of the Relative Valuation is 394.44 – 716.85 INR.

| Range | Selected | |

| Trailing P/E multiples | 15.6x – 18.2x | 16.9x |

| Forward P/E multiples | 18.6x – 27.0x | 22.9x |

| Fair Price | 394.44 – 716.85 | 517.07 |

| Upside | -44.8% – 0.3% | -27.6% |

Forward P/E Uses projected EPS for the next 12 months to incorporate future expectations.

https://valueinvesting.io/SBICARD.NS/valuation/intrinsic-value

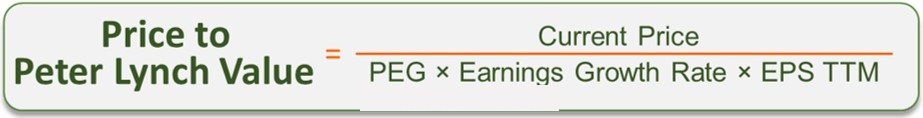

PEG Ratio by Peterlynch formula

SBICARD.NS Fair Value = Earnings Growth Rate x TTM EPS

SBICARD.NS Fair Value = 25 x 25.32

SBICARD.NS Fair Value = 632.92

Peter Lynch Fair Value PEG * Earnings Growth Rate x TTM EPS

According to Peter Lynch, a growth company’s P/E should equal its growth rate, so the PEG should equal to 1.

Price to Peter Lynch Fair Value

Peg x EBITDA (5Y CAGR) X EPS TTM)

instead of Earnings Growth Rate. we laso ebidta

100/25=4

book value is more important for banks. An ideal growth rate range is between 10%-20% a year

EBIDTA for non banking companies.

EV/EBITDA ratio TTM EBITDA +54% upside 1100

EV/EBITDA ratio is calculated by dividing the enterprise value by the TTM EBITDA. SBICARD.NS’s latest enterprise value is 1,051,190 mil INR. SBICARD.NS’s TTM EBITDA according to its financial statements is 60,240 mil INR. Dividing these 2 quantities gives us the above SBICARD.NS EV/EBITDA ratio.

| (INR in millions except Fair Price) | |||

| Trailing | Forward | ||

| Market Cap (INR mil) | EV/EBITDA | EV/EBITDA | |

| SBI Cards and Payment Services Ltd | 679,575 | 17.5x | 16.9x |

| Sundaram Finance Ltd | 469,270 | 38.4x | 86.7x |

| Mahindra and Mahindra Financial Services Ltd | 377,044 | 26.4x | 67.3x |

| Shriram City Union Finance Ltd | 148,179 | 19.9x | 34.8x |

| Manappuram Finance Ltd | 177,497 | 13.4x | 20.3x |

| Cholamandalam Investment and Finance Company Ltd | 1,163,818 | 41.2x | 68.6x |

| Cholamandalam Financial Holdings Ltd | 288,829 | 8x | 10.2x |

| Muthoot Finance Ltd | 753,809 | 20.8x | 35.9x |

| Paul Merchants Ltd | 2,460 | 2x | 1.9x |

| IndoStar Capital Finance Ltd | 30,116 | 3.2x | 6.5x |

| Industry median | 18.7x | 27.6x | |

| (*) EBITDA | 60,240 | 62,045 | |

| Enterprise value | 1,126,486 | 1,709,337 | |

| (-) Net debt | 371,615 | 371,615 | |

| Equity value | 754,872 | 1,337,722 | |

| (/) Outstanding shares | 951 | 951 | |

| Fair price | 794 | 1,407 | |

Earnings power value (EPV)

estimate the intrinsic value of a stock under the implicit assumption that the current earnings and cost of capital are sustainable. no growth rate

weighted average cost of capital (WACC)

EPV= Adjusted earnings / WACC

72,665/11.1%= 305.10

Dividend Discount Model – Stable Growth

| Range | Range | Selected |

| Long-term Growth Rate | 2.0% – 4.0% | 3.0% |

| Cost of equity | 12.8% – 16.1% | 14.5% |

| Fair Price | 125.51 – 258.27 | 191.89 |

| Upside | -82.4% – -63.9% | -73.1% |

“Cost of equity” refers to the rate of return expected on an investment funded through equity. Investors and business owners use the metric to determine if a project or business investment is worthwhile