admissions: january / july sessions

Total Programme fee for two semesters = Rs. 20,000/-

duraton 1 year or 3 years

The structure of PG Diploma Programme is:

• 9 courses (9 X 4 credits = 36 credits) – Two Compulsory courses and Seven elective courses from the chosen

specialization area;

• Two Semesters (OneYear);

3.2 Eligibility:

• Any graduate (Including Chartered Accountancy/Cost Accountancy/Company Secretaryship) with 50% marks for general

category/45% for reserved category as per government of India rules.

• No age bar

3.3 Duration:

• Minimum – One year (Two Semesters)

• Maximum – Three years (Six Semesters)

Students will be allowed to register/re-register five courses in the first semester and four courses in the second semester to enable

them to register/re-register all the required 9 courses for the award of PG Diploma in two semesters (i.e. one year). The student

has to register for the programme in the first semester and subsequently re-register for the other semester. The programme

fees have to be paid while registering for the programme.

Syllabus pdf : here

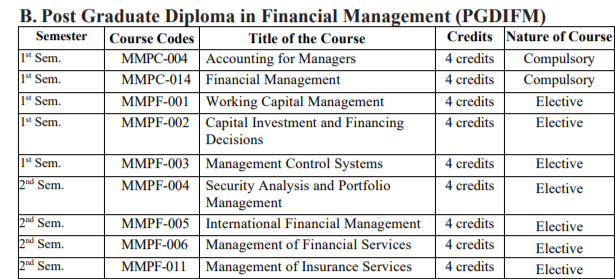

Post Graduate Diploma in Financial Management (PGDIFM) syllabus ignou

- 1st Sem. MMPC-004 Accounting for Managers

1st Sem. MMPC-014 Financial Management

1st Sem. MMPF-001 Working Capital Management

1st Sem. MMPF-002 Capital Investment and Financing

Decisions

1st Sem. MMPF-003 Management Control Systems

2nd Sem. MMPF-004 Security Analysis and Portfolio

Management

2nd Sem. MMPF-005 International Financial Management

2nd Sem. MMPF-006 Management of Financial Services

2nd Sem. MMPF-011 Management of Insurance Services

MMPC-014: FINANCIAL MANAGEMENT

Block-I: Financial Management: An Overview

Unit-1: Financial Management: An Introduction

Unit-2: Time Value of Money

Unit-3: Risk & Return

Unit-4: Valuation of Securities

Block-II: Cost of Capital and Investment Decisions

Unit-5: Cost of Capital

Unit-6: Capital Budgeting

Unit-7: Working Capital

Block-III: Financing Decisions

Unit-8: Financial Markets

Unit-9: Sources of Finance

Unit-10: Capital Structure

Unit-11: Leverage Analysis

Block-IV: Dividend Decisions

Unit-12: Theories of Dividends

Unit-13: Dividend Policies

Block-V: Emerging Issues of Finance

Unit-14: Behavioural Finance

Unit-15: Financial Restructuring

36

MMPF-001: WORKING CAPITAL MANAGEMENT

Block-I: Concepts and Determination

Unit-1: Conceptual Framework

Unit-2: Operating Environment of Working Capital

Unit-3: Determination of Working Capital

Block-II: Management of Current Assets

Unit-4: Management of Receivables

Unit-5: Management of Cash

Unit-6: Management of Marketable Securities

Unit-7: Management of Inventory

Block-III: Financing of Working Capital

Unit-8: Theories and Approaches

Unit-9: Payables Management

Unit-10: Bank Credit – Principles and Practices

Unit-11: Other Sources of Short Term Finance

Block-IV: Working Capital Management: Issues and Practices

Unit-12: Working Capital Management in SMEs

Unit-13: Working Capital Management in Large Companies

Unit-14: Working Capital Management in MNCs

Unit-15: Case Studies

\

37

MMPF-002: CAPITAL INVESTMENT AND FINANCING DECISIONS

Block-I: Financial Decisions: An Overview

Unit-1: Nature of Long Term Financial Decisions

Unit-2: Cost of Capital

Unit-3: Capital Structure – Strategic Decisions

Block-II: Investment Decisions Under Certainty

Unit-4: Project Planning and Formulation

Unit-5: Investment Appraisal – Evaluation Criteria

Unit-6: Project Implementation and Control

Unit-7: Social Cost-benefit Analysis

Block-III: Investment Decisions Under Uncertainty

Unit-8: Investment Decisions – Risk & Uncertainty – I

Unit-9: Investment Decisions – Risk & Uncertainty – II

Block-IV: Long Term Financing Decisions

Unit-10: Financing through Domestic Capital Markets

Unit-11: Financing through Global Capital Markets

Unit-12: Other Modes of Financing

Block-V: Strategic Financial Decisions

Unit-13: Capital Restructuring

Unit-14: Financial Engineering

Unit-15: Investor Relations

38

MMPF-003: MANAGEMENT CONTROL SYSTEMS

Block-I: Management Control: Concepts and Contexts

Unit-1: Management Control Systems: An Introduction

Unit-2: Strategies and Management Control

Unit-3: Designing Management Control Systems

Block-II: Management Control Structure

Unit-4: Responsibility Centre

Unit-5: Cost Centres

Unit-6: Profit Centres

Unit-7: Investment Centres

Unit-8: Transfer Pricing

Block-III: Management Control Process

Unit-9: Budgeting and Reporting

Unit-10: Performance Measurement

Unit-11: Reward and Compensation

Unit-12: Techniques of Management and Management Control

Block-IV: Management Control in Some Special Organisations

Unit-13: Service Organisations

Unit-14: Multinational and Export Organisations

Unit-15: Management Control of Projects

Unit-16: Other Organizations

39

MMPF-004: SECURITY ANALYSIS AND PORTFOLIO MANAGEMENT

Block 1: An Overview

Unit-1: Introduction to Investment

Unit-2: Securities Market (regulation)

Unit-3: Risk and Return

Unit-4: Investment Theories

Block 2: Security Analysis

Unit-5: Economy Analysis

Unit-6: Industry Analysis

Unit-7: Company Analysis

Unit-8: Technical Analysis

Unit-9: Valuation of Securities

Block 3: Portfolio Management

Unit-10: Portfolio Analysis

Unit-11: Portfolio Selection

Unit-12: Capital Market Theory

Unit-13: Portfolio Revision

Block 4: Institutional and Managed Portfolios

Unit-14: Mutual Funds

Unit-15: Performance Evaluation of Managed Portfolio

40

MMPF-005: INTERNATIONAL FINANCIAL MANAGEMENT

Block I: International Financial Management

Unit-1: International Financial Management: An Introduction

Unit-2: The International Monetary System

Unit-3: The Balance of Payments and Exchange Rates

Block II: Foreign Exchange Market and Risk Management

Unit-4: Foreign Exchange Market and Exchange Rate Determination

Unit-5: Parity Conditions in International Finance and Currency Forecasting

Unit-6: Currency Futures, Options and Swaps

Unit-7: Management of Exposures

Block III: International Financing Decisions

Unit-8: Raising Funds from International Market

Unit-9: Financing Foreign Trade

Unit-10: Cost of Capital and Multinational Capital Structure

Block IV: International Investment Decisions

Unit-11: International Capital Budgeting

Unit-12: Working Capital Management for MNCs

Unit-13: Foreign Market Entry Strategies and Country Risk Management

Unit-14: International Portfolio Investment & International Asset Pricing

41

MMPF-006: MANAGEMENT OF FINANCIAL SERVICES

Block-I: Indian Financial System

Unit-1: Financial Systems and Markets: An Overview

Unit-2: Introduction to Financial Services

Unit-3: Regulatory Framework

Block-II: Fee Based Services

Unit-4: Merchant Banking

Unit-5: Broking and Trading

Unit-6: Credit Rating

Unit-7: Mutual Funds

Unit-8: Depository Services

Unit-9: Corporate Advisory Services

Block-III: Fund Based Services

Unit-10: Leasing and Hire Purchase

Unit-11: Housing Finance

Unit-12: Venture Capital

Unit-13: Factoring, Forfaiting, Bill Discounting and Asset Securitization

Unit-14: Other Services

Block-IV: Emerging Issues in Financial Services

Unit-15: Management of Risk in Financial Services

Unit-16: Technology and Financial Services

Unit-17: Portfolio Management Services

42

MMPF-011: MANAGEMENT OF INSURANCE SERVICES

Block-I: Indian Insurance Sector: An Overview

Unit-1: Introduction to Insurance

Unit-2: Organisation Structure of Insurance Sector

Unit-3: Legal and Regulatory Environment

Block-II: Life Insurance

Unit-4: Life Insurance Policies

Unit-5: Group Insurance

Unit-6: Micro Insurance

Block-III: General Insurance

Unit-7: Health Insurance

Unit-8: Motor Insurance

Unit-9: Property Insurance

Unit-10: Agriculture Insurance

Unit-11: Other Types of Insurances

Block-IV: Managerial Issues of Insurance Sector

Unit-12: Corporate Governance for Insurance Sector

Unit-13: CSR in Insurance Sector

Unit-14: Solvency and Asset Liability Management

Unit-15: Financial Schemes of Government of India

PG Diploma in financial management career opportunities

fincial analyst

Job description

Analyze financial statements to evaluate investment opportunities.

Create financial modeling for investors to find profitable investments.

Recommend individual investments collections of investments

Asses the performance of stocks,investments,bonds.

0 – 5 years

3.75-8 Lacs P.A.

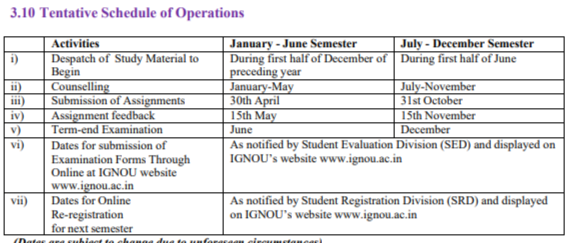

Term End Examination will be held in June and December every year for all the courses